Marco Di Maggio: Putting the BS in HBS

What role did Harvard Business School play in the collapse of TerraUSD?

If you even tangentially follow the crypto markets, you have heard of Terra/Luna.

“Terra” and “Luna” are the latin words for “earth“ and “moon.” I am not going to get into the details of algorithmic stablecoins, but just know that they are supposed to balance each other out — users can burn Luna to mint Terra, and burn Terra to mint Luna. They work in harmony like the earth and the moon which gravitate around each other to provide stability, thus keeping TerraUSD balanced at $1 USD.

When this harmony was broken a couple of months ago, and TerraUSD lost its peg, it crashed the crypto ecosystem in spectacular fashion and hundreds of billions of dollars were wiped out overnight. TerraUSD turned out to be nothing more than a huge Ponzi scheme.

In the aftermath of the Terra crash, a multitude of articles were written about Do Kwon, the eccentric evil genius behind it. And rightfully so. He was primarily responsible. Part of what makes Kwon such an attractive figure to write about is that he is larger than life — a rich whizz kid with a big mouth and bigger balls.

What zero articles have focused on, however, is a stuffy old professor of finance at boring ol’ Harvard Business school (HBS). Enter Marco Di Maggio.

Marco was instrumental in the collapse of Terra and yet has walked away seemingly unscathed & unnoticed (so far) thanks to some slick Harvard-esque damage control and blame deflection. It is not known how many tens or hundreds of millions of dollars he pocketed at the expense of those who fell for his Ponzi scheme.

Just how central was Marco to Terra? Well, let’s take a look at the foundational Terra whitepapers, the very bedrock upon which Terra is outlined. His name is on all the founding documents:

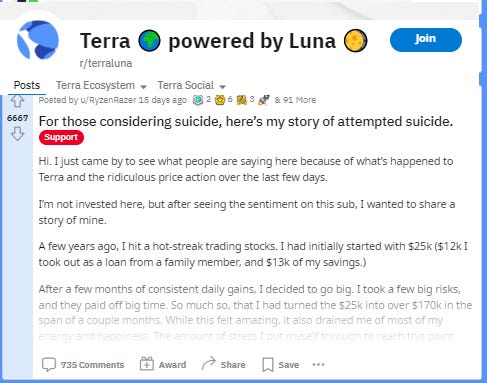

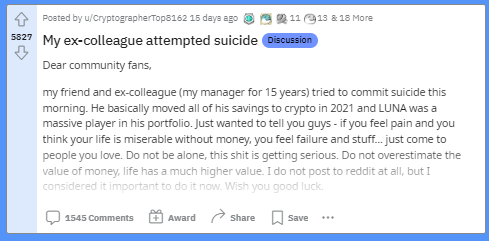

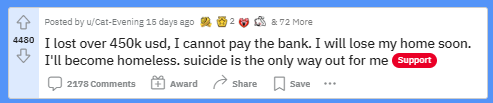

Suicides

To give you a sense of the scale of this crash and the impact it had on regular people, I recommend you visit the /r/terraluna subreddit and filter by top posts all time.

Here are the top posts of all time:

I am not saying Marco is responsible for these suicides, but I am not not saying that either. Grazzie Marco!

The reason this crash was so devastating is that the whole point of a stablecoin is that it is supposed to be a safe, stable asset that always maintained a peg. So people had their life savings parked in TerraUSD with the promise that it would always be stable. It wasn’t supposed to be a speculative asset; it was supposed to be a safe harbor where you could park your cash to achieve peace of mind. And then it went to zero.

Marco even assured everyone that he ran one million years of simulation! He writes:

"Our findings, based on 1 million years’ worth of simulation data, indicate that Terra’s peg is highly robust under both forms of stress."

Don't blame him. It's a once-in-a-million-year unlucky event!

OK, Marco.

As an EJMR user writes:

This is the type of insight you can hope for after 5 years of intense PhD training and exposure to elite research minds of academia. It's the usual: Make a simplified model of reality. Use a simplified model to make bold predictions. Bold predictions are falsified by reality. Marco, next time before you hype up your paper take a deep breath and assume your paper is pure bs.

The question is not "do you have a better model". The question is you wrote a model to peg a currency without any underlying physical assets. The peg then got attacked and destroyed as everyone had literally predicted would happen since the protocol had been released.

The Anchor Mechanism

The very first thing you will learn in your very first economics class in college is the maxim that “there is no free lunch.” Greg Mankiw, a tenured professor of economics at Harvard, describes the concept of no free lunch as follows: "To get one thing that we like, we usually have to give up another thing that we like. Making decisions requires trading off one goal against another.”

In the case of crypto, what we want is yield, and what we have to give up to get that yield is risk. People don’t enjoy taking risk, but are willing to do so if they are sufficiently compensated. This is why any self-respecting economist — let alone a finance professor at Harvard! — should instinctively raise their eyebrows, if not outright reject, ridicule, and denigrate any investment that purports to offer a 20% annual return with no risk. 20% return for no risk is unthinkable.

And yet that is exactly what Anchor was. It offered a 20% annual return for no risk, and rather than ring the alarm bells, Di Maggio repeatedly touted Anchor as the "Gold Standard for Passive Income."

To nobody’s surprise, the 20% “risk-free” yield turned out to be unsustainable. Funds from new investors were being used to pay off old investors, thus initiating a Ponzi death spiral. If you can't figure out what is generating yield, you are the yield. There is not a single financial economist who would see the project and not immediately know it is a scam.

Crazy that a HBS Professor would put his face on it, and even crazier that he has received no media scrutiny and gone back to teaching and partying at academic conferenecs. At the very best — my most charitable assessment — is that Marco wrote a marketing paper for bloodmoney similar to scientists funded by cigarette companies.

The Whitewash

As far as I can tell, Marco has only commented once on the collapse of Terra, in a carefully curated piece in the Financial Times that was doubtlessly arranged by the Harvard communications department. He says:

Di Maggio told FT that the terra he once knew was no more. The terra he wrote about planned to peg a stablecoin to the Korean won. His analysis of how that system might fare under strain was therefore no longer relevant, he argued.

Do Kwon decided to introduce a borrowing and lending protocol called Anchor — Terra’s first attempt to enter the market of decentralised finance. The initial idea was to allow users to borrow the terra stablecoin for other transactions within the ecosystem. In the original design, the interest rate paid to lenders should have been a market rate determined by the borrowing demand. This would have made it sustainable without posing any risk to the overall design. Instead, to attract attention and grow the company, Do Kwon decided to subsidise and fix the deposit returns for lenders at 20% APY. All of us on the research team knew this would create an unstable system with unsustainable growth of supply. With such a high rate, Anchor attracted about $15 billion worth of capital. But the growth of the underlying capital, now decoupled from the borrowing demand, made the whole system very fragile. Depositors could withdraw large amounts of capital, sell it on the market, and cause the stablecoin to lose its peg to the US dollar. We tried to explain the risk and instability of these proposed fixed returns to Terra leadership. But with no decision-making power in the company, our words were ignored.

— Marco Di Maggio on the collapse of terra

One paragraph of contrition and Marco is let off the hook? It wasn’t even contrition… there was no apology. Just pointing the finger and deflecting accountability. Very sick and twisted.

Should Law Enforcement Accept Marco’s Excuse?

This all boils down to whether or not Marco knew that Terra was a front for massive fraud, or if he was simply a useful idiot who sold out the HBS brand name for a buck. To me, it is clearly the former.

I mean, Marco’s only excuse is that he knew it was a scam so he quit in disgust before it blew up. Okay… but.. if he knew it was a scam that was inevitably going to blow up and was so indignant that he quit…… didn’t he have a moral responsibility to blow the whistle?

Instead of saying anything, he was content to sit back and count his bloodmoney and watch the Ponzi grow and grow and grow; then sat back and watched bagholders kill themselves.

I know in academia there are no consequences for bad ideas but in the real world that is called investment fraud. The idea was fundamentally wrong, people told them it was wrong, but they went ahead and took billions from investors anyway. Marco didn’t just fake some regressions — we are talking about a gigantic Ponzi scheme that wiped out billions of dollars and damaged public trust in crypto, with Marco's happy face attached to it saying, "This is not going to crash in literally a million years. Trust me, I teach at Harvard."

Marco seems to have gotten away with it, the media has ignored him, which is the purpose of writing this article. He deserves more media scrutiny. I’m surprised that Marco’s involvement hasn’t become a bigger story yet. He deserves to be put on trial, and the public deserves the right to read emails produced in court filings to see who knew what and when did they know it.

Don’t take Marco’s word for his involvement. It needs to be proven in court.

I still think Marco’s involvement in Terra will become a bigger story. This isn’t over yet.

Given the amount of money lost and people affected in multiple countries, everyone involved in Terra can expect to be sued for the next decade in every jurisdiction possible. Unfortunately for lil’ Marco, all the other Terra devs are in countries with no extradition — Do Kwon fled to Singapore — but Marco is still on US soil. I, therefore, suspect that Marco and Harvard will ultimately end up being the American face for the mountain of Terra lawsuits.

Beyond the forthcoming lawsuits, I think Marco should be fired from Harvard and sent to jail. At the very least he should be denied tenure and blackballed from the academic community. How can any scholar trust any of his research ever again? The academic finance community is OK with him showing up to their conferences and partying with them? Seriously? What a cesspool.

When the dust settles, maybe Harvard Business School can write a case study about this imbroglio. It is a textbook example of unethical behavior and deserves to be written in textbooks as a warning to all future MBA students on how not to act.

Report him to the Massachusetts Security Commission.