Tenured Georgetown professor scrubbed from faculty directory following Karlstack investigation

plus, a cover-up at the Journal of Financial and Quantitative Analysis (JFQA)

I still believe that this story I broke in September is the biggest finance-academia scandal in several years:

To jog your memory, here is a ChatGPT summary:

The scandal involves a paper by Bai, Bali, and Wen (BBW) in the "Journal of Financial Economics", a top finance journal. BBW's paper, central to global bond markets, contained major errors, leading to its retraction—the first ever for the journal. These errors, involving lead/lag mistakes and undisclosed data truncation (winsorization), invalidated their findings. This has significant implications, as numerous papers citing BBW are now questionable. The scandal raises concerns about academic integrity and the impact on finance research, with Georgetown University, the authors' institution, notably silent on the matter.

The thing about academia is that it moves slowly — if there are any repercussions for fraud at all, which is rare, they usually takes many months, or even years, to materialize. This is, of course, a feature, not a bug, meant to protect institutions and bad actors while hoping that journalists shrug and get bored at the Kafkaesque bureaucracy. So, what I often have to do is stay on top of these stories for months and continuously push/drag/nudge/hound them along… This is what I am doing with today’s post, by providing these two updates:

Update 1

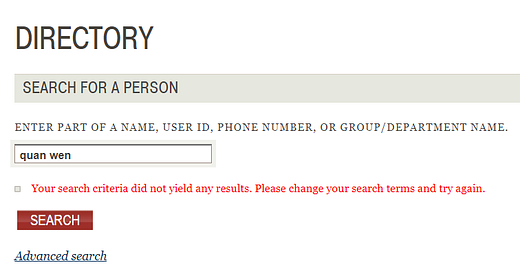

One of the subjects of that article, Dr. Quan Wen, after having his best paper retracted, has now been scrubbed from Georgetown’s faculty directory.

https://contact.georgetown.edu/

Note that Dr. Wen's personal site remains active, but it has also been disconnected from the Finance department's listings. Click on any professor's name here, then click on Quan Wen's name, he is the only one with a dead link:

https://msb.georgetown.edu/faculty-research/finance/

So, he’s been cut loose from both the faculty directory and finance directory.

I reached out to Quan directly, as well as Georgetown deans/provosts, to confirm if this missing webpage is a glitch, or if there is some other innocent explanation that caused his link to go down. I told them that if it was a simple glitch, or if there was some easy explanation, I would not publish my article, but they did not respond. You would think if it was a simple misunderstanding they would instantly clear that up with a two-word email.

Speculation abounds on EJMR, with unverified claims about Dr. Wen's potential resignation or firing, or that he was the co-author most directly responsible for the fraud exposed in my original article. Remember that during my original article, I spoke on the phone with an expert in the field of corporate bond literature—a finance professor who requested anonymity. He expressed his conviction, albeit unprovable, that not all the authors share equal culpability in this scandal. In his words:

This is probably one of the biggest cases of fraud or incompetence in academic finance's history. But not all of the coauthors might have been aware that it was happening.

— Anonymous finance professor

It’s all speculation at this point, but being removed from the faculty directory and then refusing to comment on the removal is definitely fanning the flames. The timing of the scrubbing coincides with the end of the academic term and the onset of the Christmas break, which would make sense, especially for a tenured professor.

To be continued.

Update 2: JFQA Corrigendum to Turan Bali's article

In a previous article, I highlighted a fatal flaw in a seminal paper, revealing a ripple effect that compromises the integrity of an entire research field — there are dozens, or hundreds, of papers that need to either be retracted or corrected. That’s why this is such a big deal, the scale is staggering.

Well, the next ripple has now rippled out. This correction may represent the beginning of a broader corrective action in the field:

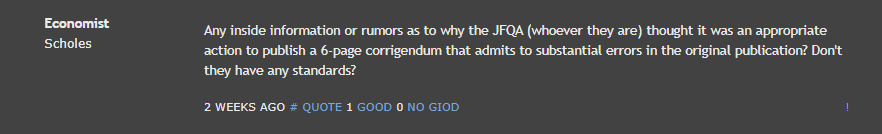

I read the 6-page corrigendum myself. I must admit, I do not have strong opinions on whether replacing the BBW factors with alternative factor models makes econometric sense... as a humble wordcel, I had a hard time parsing the theory, or interpreting the tables of coefficients. Thus, I will not write my own opinions about the validity of this correction; I will simply link to the EJMR thread.

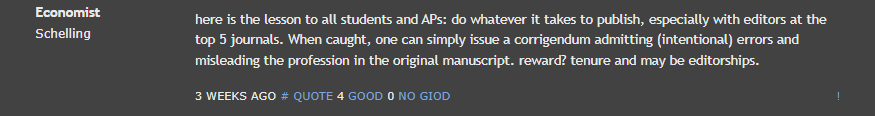

The profession has strong opinions:

My take is that JFQA swept this under the rug; they got away with a corrigendum when a full retraction might have been more justifiable. This is likely an attempt to subtly address the problem without fully acknowledging its severity.

Still, it's noteworthy that even a corrigendum represents a step towards accountability, especially when compared to the dozens of other academic journals that have yet to acknowledge the flawed research published on their pages. The entire field of study being flawed is a much bigger story... it’s way bigger than just this one (now-corrected) paper… unless more dominos start falling soon, an untold number of fatally flawed papers will (probably?) go uncorrected and unretracted.

An entire literature is rotten.

In this light, JFQA's decision to issue a correction, albeit frustrating, is somewhat commendable compared to the inaction of others — it at least contributes something towards addressing the concerns of academic integrity and responsibility.

The bar for accountability in finance is really, really low.

Hmm. If you take BSW and remove the W you are left with BS. Seems like.

Nice work. Thank you from all of us