My first Substack article (actually, the first article I ever wrote anywhere, ever) was The Federal Reserve Goes Woke.

That article will always hold a sentimental place in my heart — I fondly recall the nervousness & trepidation that any new writer feels upon nakedly putting themselves out on a limb for the first time

A big reason for the success of this article was that

Quote Tweeted it to his 0.5 million Twitter followers, adding simply, “seems a little over the top.”While this was ostensible criticism (everyone is the comment section of the tweet was mercilessly mocking me), I am 90% sure that he was giving a straussian wink, perhaps to magnanimously boost a new writer, perhaps because he agreed with me with about the future of the Fed.

repeatedly tweeted the article out to her 30,000+ twitter followers, which gave it a big boost.This was before I had any subscribers at all, and is what kickstarted my Substack career.

Anyways, thanks Matt and Claudia. I suppose I should return the favor:

I ended that article with an emphatic call for Lisa Cook to not be nominated to the Fed board… and over the next year she was nominated and confirmed. Nominating an incompetent black woman to one of the most powerful positions in the world simply because she is a black woman is about as woke as you can get, and lying while you do it (“She’s a leading expert on monetary policy! She’s a genius!”) is par for the course.

With Lisa Cook at the helm, the Fed has only descended further into wokeness and will continue to do so at an accelerated pace moving forward. As such, it’s worth following up on this phenomenon because once the public loses trust in the Fed, it’s over. That’s the whole ballgame. That’s the end of fiat currency.

Auston Goolsbee: A Poor Man’s Paul Krugman

In December 2022, Dr. Austan Goolsbee was named the next Chicago Fed president.

Hilariously, he has blocked me on Twitter despite the fact that I have never interacted with him:

Goolsbee is a professor of economics at the University of Chicago, and by all accounts a very good one (just like Paul Krugman was an excellent trade economist back in his day). Goolsbee’s 10,695 citations on Google Scholar are more than 10 times what Lisa Cook has, and they graduated from their PhDs at nearly the same time.

I spoke with another UChicago economist, Dr. Harald Uhlig about this appointment.

Here is what he had to say:

I have not interacted with him much. I guess econ prof in Chicago plus Washington experience makes him highly qualified in the eyes of those that selected him. I am always happy if good things happen to a colleague of mine. He is not a monetary economist, though, and there are plenty of excellent ones in the area. So this looks like another case of appointment due to connection rather than specific expertise. At least his academic record strikes me as legit.

While Goolsbee is indeed “not a monetary economist,” the traditional prerequisite for Fed leadership, I think it's not terrible to have a public finance economist on the FOMC who understands fiscal policy much better than monetary economists.

The “Washington experience” and “another case of appointment due to connection rather than specific expertise” lines are much more problematic, and get to the crux of the issue — for all intents and purposes (this is my opinion, not Uhlig’s) Goolsbee is no longer an economist, he’s a politician… an extremely left-wing partisan operative.

Goolsbee was Chairman of Obama’s Council of Economic Advisers and served in the Obama Cabinet. In 2019 he endorsed Pete Buttigieg for President. In the 2020 general election, he co-chaired the Economic Advisory Council for the Joe Biden Campaign.

While he himself is not overtly “woke,” per se, he will side with the Democrat party line 100% of the time. That’s his entire schtick— he’s a salesman trotted out to give a veneer of “technocrat” to whatever the Dems him to. The Dem line in the year 2023 is to blindly support an uber-woke fed, thus you can be sure he will too. He’s a good soldier. A mouthpiece. A water carry-er. A loyal bannerman. That’s all he is.

In his role as Obama’s CEA chair, he utilized his homespun, folksy, high-IQ huckstership to turn the Office of the CEA into a pure partisan sales show.

Goolsbee is the attack dog sent to do the cable TV circuit whenever the blue team has propaganda to push.

Here he is, for example, arguing just a few months ago that 2 consecutive quarters of negative GDP growth is not the definition of a recession.

Remember that whole “2 quarters of negative GDP growth is not a recession!” psyop?

Yeah, Goolsbee is the one who psyop’d you. He’ll say anything he’s told to by his masters.

Another example of his willingness to lie to support the blue agenda is when he went on TV and talked about how there are only ~6 million undocumented immigrants in the United States… so we shouldn’t worry about it too much.

This is especially blatant because Goolsbee had just reviewed a paper where the opening line is, “The Department of Homeland Security estimates that 11.4 million undocumented persons reside in the United States.”

To further underscore how hyper-partisan he is, here is a great blog post by The Grumpy Economist which goes into depth about Goolsbee being a political hack. This article says that “Austan is repeating a well-orchestrated bit of democratic party spin, talking point, or propaganda.” and that “Usually, ‘‘actual economics’ finds little value in either party’s porgapada. Echoing that propaganda is a sure sign of empty analysis, so avoid it.”

“When Austan wraps his political dog-whistles in "I'm an Actual Economist" and shows his PhD, honest citizens don't so much update the deep truth of democratic party propaganda, they update on what academic credentials mean, and what academic research and analysis is. No, 99% of us are not here to scream one party's talking points are the utter truth, and the others scheming evildoers.”

Goolsbee’s descent into political hackdom mirrors that of Paul Krugman — once respected as a bookish academic, he has now fully sold his soul to the Dem apparatus.

Guess he thought imitating Kruggles was the key to success, and hey, looks like he was right. He’s playing the game successfully. The fact that it’s working for him doesn’t make it right, though. Appointing Auston Goolsbee to lead the Chicago Fed would be analogous to appointing Peter Navarro. I have no issues with Peter Navarro as a person, per se, but I still wouldn’t appoint him to the Fed because he’s an overtly partisan pugilistic, and that’s all he is.

This is a race to the bottom. Moving forward, you can be sure that Ron DeSantis will appoint a bevy of Peter Navarro types to the Fed simply because it;s necessary to fight fire with fire, and Dems will flip their shit when he does, shrieking about the sanctity of an independant , non-partisan Fed.

But they will have brought the erosion of the Fed’s independence on themselves — it will have been 100% self-inflicted, and entirely foreseeable. It’s sad to watch the integrity of the Fed crumble and being unable to do anything about it. It feels like I am in sleep paralysis. This sort of thing does a real disservice to your profession and the role of economists generally in objectively giving policy advice.

This is neither here nor there, but Goolsbee is also a member of the Skull and Bones secret society. In my humble opinion, nobody who is a member of a Satanic-sex-orgy-cult should be allowed to have any power over a nation’s purse strings, just as a matter of common sense.

Republicans Pick a Fight With Mission Creep

The problem with fighting mission creep is that people find it extremely boring.

That’s the insidious nature of a “creep” or a “long march through institutions” — it’s a war of attrition waged over the course of many years, so there is never any sense of urgency.

Despite how boring it is, mission creep has stubbornly clung onto the periphery of public discourse and has been written about ad-nauseum by the mainstream financial press; a new mission creep article pops up every few weeks, seemingly it’s the go-to topic that Fed watchers write about when they run out of other ideas. Yet none of these articles ever go remotely viral… because nobody really cares.

If the right-wing had any modicum of media prowess, they would rebrand mission creep as something sexier; maybe describe it as totalitarianism and stress how bureaucracy co-opts the private sector to accomplish its ends. It's fascism really. These fascists can't accomplish their goals democratically, so they subvert democracy and instead focus on wielding power via an unelected administrative state.

Seriously: call it “fascist creep” rather than “mission creep” and watch how much more traction your articles get. Branding is important, and I don’t think this new term is needlessly inflammatory, this is a very real existential threat that can accurately be described as fascism. If the Federal Reserve continues to focus on objectives that are outside of this core mission, it will not be able to effectively fulfill its primary responsibilities. They’ve already fallen asleep at the wheel and caused the highest inflation in several generations, and instead of redoubling on their core mission of low prices and stable employment, they choose to double down on activism? Madness.

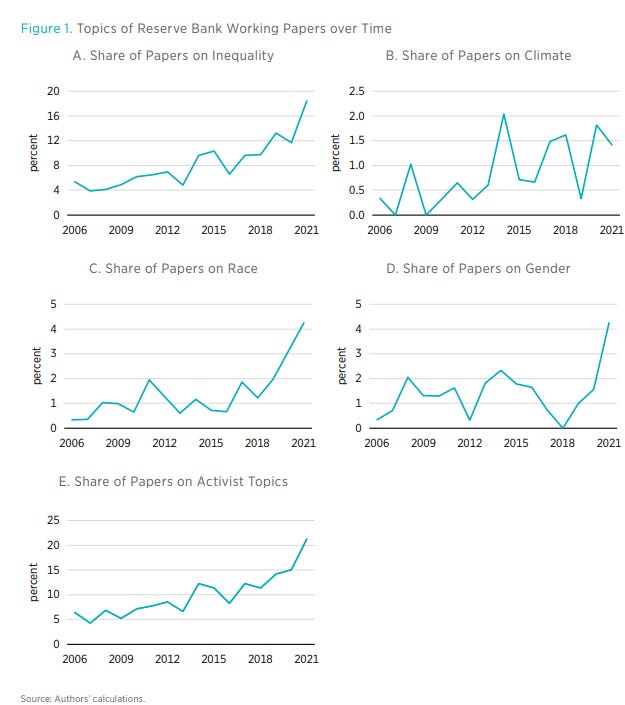

To quantify this focus on activism, the Mercatus Center published a report in 2022 titled "Mission Critical or Mission Creep? The Research Function of the Federal Reserve Banks," which found that:

The Fed regional banks' research staffs have increasingly engaged in research on activist topics (i.e., inequality, climate, race, and gender).

More than one-fifth of all Fed regional bank papers were coded as activist in 2021, versus between four and eight percent each year from 2006 through 2013.

Increasingly activist research agendas could pose problems if the public comes to view the regional Fed banks' research as controversial or designed to influence public opinion on politically charged topics. Activist research agendas risk politicizing the Fed, which values its reputation as a politically independent, technocratic institution.

Here is what this focus on activist topics looks like:

Now that this has proven to be happening, the old line “this isn’t happening!” has predictably shifted to “it’s a good thing this is happening! Diversity and climate has always been the purview of the fed!”

One major sign of pushback from within the Fed came in December 2nd, 2022, when Chris Waller, a member of the Federal Reserve's Board of Governors, put out the following press release:

I cannot support this issuance of guidance on climate change. Climate change is real, but I disagree with the premise that it poses a serious risk to the safety and soundness of large banks and the financial stability of the United States. The Federal Reserve conducts regular stress tests on large banks that impose extremely severe macroeconomic shocks and they show that the banks are resilient.

This is an extraordinary statement simply because the Fed generally likes to present a united front, and any dissent whatsoever is usually minor, if at all. The fact that someone in the Fed leadership broke ranks and came out with this strongly-worded anti-activist statement is… unprecedented.

A second sign of pushback came just a few weeks later, when the Senate Republicans introduced the Federal Reserve Accountability Act of 2022.

There are a few random provisions in the bill, such as geographic requirements and anti-lobbying provisions, but we will ignore those for now as they are ancillary.

There are 2 main aspects to this legislation:

Makes the presidents of the Fed regional banks (such as Austan Goolsbee!) presidentially-appointed and Senate-confirmed positions.

Currently, they are selected by their private sector boards of directors and then are approved by the Fed Board of Governors in Washington.

Reduces the number of Fed regional banks and Federal Reserve districts from 12 to 5.

Boston, Philadelphia, Richmond, Atlanta, Chicago, St. Louis, and Minneapolis will dissapear, while New York, Cleveland, Kansas City, Dallas, and San Francisco. will survive.

I am happy about this if for no other reason than it’s ridiculously inefficient to have 2 out of the 12 banks, St. Louis and Kansas City, both located in the state of Missouri.

I am confused why this bill hasn’t gotten more attention; it totally blows up the dynamics of the monetary system which have been status quo for the past 100+ years, since The Fed's 12-bank structure was established in the Federal Reserve Act of 1913. I guess the reason it’s gotten very little coverage in the mainstream financial press is that it has a very low probability of passing with Democrats controlling government.

Still, it’s the first sign of life I’ve seen out of the anti-mission-creep faction in… forever. At very least, I’m glad that they’ve gone on the offensive. In politics, whenever you’re not playing offense, you’re playing defense.

A pessimist might say that this is nothing more than a symbolic parting shot from Pat Toomey, the leader of the Senate Banking Committee. He was the main sponsor of this bill, and has long been the most vocal (read: the only) opponent of mission creep in the Senate. He retired last week, immediately after introducing this bill.

“Despite their narrow and nonpartisan statutory mandates, the Fed and regional Fed banks have increasingly inserted themselves into politically charged issues like global warming and social justice. Congress has a responsibility to ensure the Fed does not become a political actor. This legislation will further that important goal by reforming the Fed to make it more accountable to Congress and the American people.”

-Former Senator Pat Toomey

An optimist might say that he didn’t introduce the bill alone; it was co-sponsored by 5 other Republican Senators (Mike Lee, Cynthia Lummis, Thom Tillis, Bill Hagerty, and Ted Cruz). Perhaps they can keep the specter of this bill alive until the Republican eventually regain control of the Senate.

More generally, I think this is good because re-opening the Federal Reserve Act gives the opportunity to do lots of other stuff that should be done — it paves the way for a whole legislative agenda. For starters, the regional banks should be made public institutions that can be FOIA’d. Currently, they hide behind them being private and hide anything sensitive in the NY Fed and say you can’t FOIA it.

What impact would this bill actually have on monetary policy? It’s hard to say.

Are 5 big branches really better than 12 small branches? Why? The stated purpose of the bill is to “limit the concentration of power in Washington”, but I have a feeling concentration of power would only increase when 5 people are wielding the power that 12 people used to hold. This makes the fed system more centralized, not more decentralized.

Reducing the monitoring structure to 5 is akin to saying we should reduce the number of Congress people by 65% or we should reduce the number of police by 65%.

That argument assumed the Fed actually produces tangible value for society, though, which is unclear. More cops —> less crime. OTOH, what tangible value is provided by hundreds of PhD economists p-hacking thousands of fake papers on gender & green finance, all with predetermined conclusions? It’s merely a jobs program at this point, and I am fine with slashing it with a machete.

Arguably the more impactful change is making Fed presidents presidential appointees/Senate confirmed; this takes power away from the Fed, and I am always in favor of that. If they want to shove the next Goolsbee down our throats, they’ll need to prepare for a big political fight, rather than dictating it by waving their hands.

Although this also makes the Fed more political and at the mercy of Presidential whims, which kind of defeats the point of having an independant Fed in the first place. The Fed won’t be able to plausibly claim they are “arms-length” if this happens.

Mission Creep at the Bureau of Labor Statistics?

In the past month:

What’s going on at BLS?

Seems like they are being captured, too, and rigging the numbers for Biden.

Might be worth doing a deeper dive.

Extending FOIA to the Fed would be an incredible first step.

Excellent article. Keep writing on this subject and keep applying pressure.