Exclusive: Evidence ElonJet is a Scammer

a cautionary tale on the fallibility of human oracles and unregulated prediction markets

In case you live under a rock, the main character on Twitter for the past couple of months has been University of Central Florida undergrad Jack Sweeney, who runs a Twitter account called @ElonJet.

As the name implies, ElonJet is a robot that posts the publicly available location of Elon Musk’s private jet — when it lands, when it takes off — and has garnered over half a million followers in doing so. This account was created in June 2020, and was first targeted by Musk in 2021; he offered to pay Sweeney $5,000 to take it down.

In November 2022, as Musk purchased Twitter, he assured everyone that he would not ban ElonJet.

In December 2022, Musk banned ElonJet, as well as banned Sweeney’s personal account.

This sparked a global debate on free speech.

I’m not going to dig into this can of freezepeach worms, because this isn’t an article about freezepeache. The point of this article is that I have uncovered dirt on ElonJet.

Normally I wouldn’t care about dirt on some random university student in Florida, but he’s a media darling who has single-handedly shaped the policies concerning what you are, or are not, allowed to write on Twitter.

As a prediction market aficionado, I take great umbrage when ElonJet leverages this fame to cheat, manipulate, and corrupt the integrity of the prediction market ecosystem... these scams happen all the time in this space, and it drives me crazy; the last thing we need is one more scumbag intent on rigging the markets. Whenever I can expose the lies of bad actors in the prediction market world, I consider that a public service.

The “dirt” in question involves the Polymarket market Will the Twitter profile @ElonJet remain active through September 1?.

The rules of this betting market were as follows:

The resolution source https://twitter.com/ElonJet will be checked daily at 12 PM ET, with the last check being performed on the resolution time of September 1, 2022, 12:00:00 PM ET. If upon any of these checks the @ElonJet profile is found to be deactivated, deleted, banned or suspended in any form, while the Twitter platform is operating normally, this market will resolve to "No". Otherwise, this market will resolve to "Yes".

In the months leading up to the September 1st deadline, ElongJet was active.

6 minutes before noon on September 1st, the ElonJet account suddenly disappeared from Twitter. Here are traders reacting in real time:

23 minutes after noon, the account popped back up.

For good measure, here is a video of the account being deactivated at noon on the dot.

Ensnared In His Own Web of Lies

I reached out to Sweeney, inquiring whether he took a bribe to rig this market.

"No I didnt, from what i heard people had bots mass reporting it, the account got locked out i had to unlock the account."

-statement from ElonJet to Karlstack

The statement is a lie.

You lose all your “superfollowers” when you deactivate your own account... and ElonJet lost all its superfollowers when it went down for those fateful 29 minutes. Losing your superfollowers does not occur when you are suspended for “bots mass reporting.”

I asked ElonJet to explain this superfollower discrepancy.

Despite answering my first question, he did not reply to my follow-up.

He responded by saying “God that ass came back” and deleting my messages. He has repeatedly deleted and/or banned anyone in his discord server who asks about this scam. Wait, I thought he was a warrior for free speech?

I repeatedly offered him the chance to review this article in its entirety before publishing it, so that he could point out any factual inaccuracies. He did not take me up on the offer.

Who Had an Incentive to Offer a Bribe?

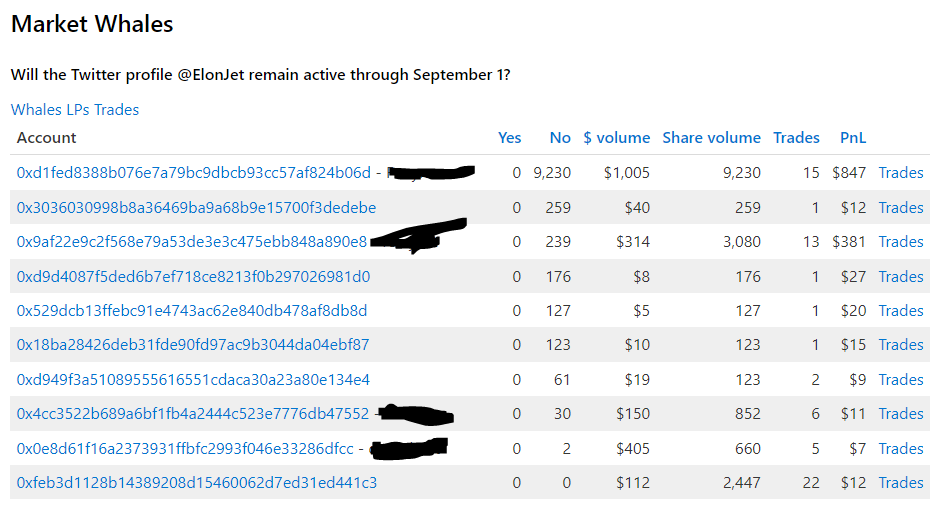

This was an extremely lopsided market — $14,200 was wagered in total, but $9,230 of that was by a single whale betting that ElonJet would have his account deactivated by the market deadline. The next biggest position was a paltry $259.

Who owns the 0xd1fed9399b076e7a79bc9dbcb93cc57af824b06d wallet? Who would score a $9,230 payday when ElonJet was deactivated at noon, for 29 minutes?

Update: after publishing this article, someone sent me this tweet.

Fingers were pointed at a well-known trader in the community going by the pseudonymous handle “Gaeten Dugas,” a glowing tribute to the Typhoid Mary of AIDS.

Here is what Gaeten Dugas had to say about these allegations.

“My friend worked with the owner of [ElonJet] to deactivate it on the last day.”

This claim directly contradicts ElonJet’s claim that the account was taken down as a result of mass bot reports.

Dugas could be pulling some elaborate troll here, making up a fake story, but I don’t think so. What incentive does he have to to fabricate a friend that worked with ElonJet to rig the market?

One incentive would be to throw the heat off himself. It’s possible he made up a fake “friend” and is blaming it on him, but that is unknowable. No way to prove it. The wallet is anonymous, and no one can hack into the relevant private messages.

I conclude that even if he wasn’t directly involved in rigging the market, Dugas bears at least passing moral responsibility because he knew about it way ahead of time and let it happen.

The darkest places in hell are reserved for those who maintain their neutrality in times of moral crisis.

On the other hand… What was he supposed to do? Is Dugas supposed to ride into every Discord server like Paul Revere, yelling that his friend had rigged the market? Go public on Twitter? He owes no fiduciary duty to other traders, nor to the Polymarket leadership team.

“Spirit of the Market” vs. "Literalist Interpretation”

Maybe this was all perfectly legal.

After all, Polymarket created this market without Sweeney’s consent.

The idea that Jack Sweeney is bound in any way by some crypto fuqtard creating an unregulated prediction market is rather insane.

— Anonymous trader

That being said, taking bribes to engage in corruption is generally frowned upon, and often illegal. The SEC/CFTC does not take kindly to a participant in a market colluding with the source of that market, with a secret exchange of funds.

*That* being said, the exact laws which might apply here are… unclear. It’s an unregulated/offshore market. Maybe it’s insider trading. Maybe it’s market manipulation. Maybe it’s corruption. Maybe it’s wire fraud; a strong case can be made that this scheme satisfies of all 4 of these criteria:

Pragmatically speaking, it’s too small for the Feds to care about. It is not worth the federal government’s time & manpower to go after teenagers that are scamming $9,230 of crypto from gamblers on an offshore, unregulated prediction market. This will go down as yet just another small-time scam in a long line of small-time scams permeating the crypto ecosystem since forever. Statistically speaking, everyone involved will get away with it.

When a sum of over $100 million USD is stolen, on the other hand, as was the case with Avi Eisenberg, they have no choice but to drop the hammer.

What many ElonJet defenders say is that this may have been corrupt, but that corruption doesn’t matter because it was done so incompetently as to have been unsuccessful… Sweeney and the briber didn’t even pull it off.

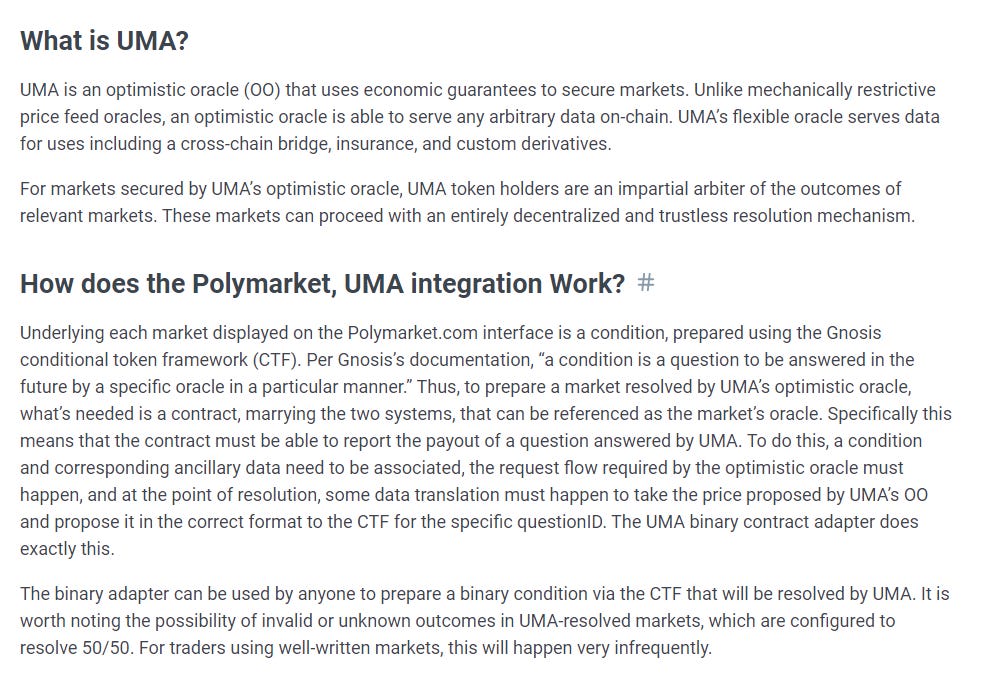

The reason their attack failed is that this market was resolved not by Polymarket, but by UMA. UMA is a system know as a “human oracle”… Think of it as a council of crypto elders who assemble to vote on ruling disputes.

The flaws in the UMA protocol are legion; the main problem is that it’s not decentralized enough; the top 10 biggest UMA wallets control 64% of the votes.

In practice this means that whenever 1 or 2 UMA whales make their voting decision public, all the small wallets mindlessly agree with him to be on the winning side of the trade. The plebs just look at the big fish and follow… and the big fish aren’t the smartest fish in the ocean. These fish are known for making schizophrenic, capricious, and/or illogical decisions.

It’s a total shitshow. Whoever owns UMA tokens can vote, and every voter has a different interpretation of the rules of each market. Is the purpose of UMA to report the actual state of the world or not?

A large (but unquantifiable) chunk of UMA voters, for example, were duped by a brigade of Polymarket trolls with a financial stake in the outcome. These trolls invaded the UMA discord and argued that the ElonJet account never actually went down, although they knew it did. This is blatantly false, but they were so loud in their kvetching that many UMA voters only gave this dispute a cursory glance before voting, so this coordinated disinformation campaign tricked them low-information-voter into voting the wrong way.

The pearl-clutching about scamming really falls flat when you consider that every single person … is fully aware that the account was inactive at noon, but decided to lie about that because they thought that UMA would be easy to game.

— Anonymous trader

The decision making process of the more highly-informed-voters, the ones who paid more attention to this case, was a little more sophisticated. Their decision boiled down to whether UMA’s role as an oracle is to interpret the rules as they are plainly written, or if they should take an activist role and stamp out any rigging of markets.

Here are the rules of the market again. This is all we have to go on:

The resolution source https://twitter.com/ElonJet will be checked daily at 12 PM ET, with the last check being performed on the resolution time of September 1, 2022, 12:00:00 PM ET. If upon any of these checks the @ElonJet profile is found to be deactivated, deleted, banned or suspended in any form, while the Twitter platform is operating normally, this market will resolve to "No". Otherwise, this market will resolve to "Yes".

A literalist reading of the rules is fairly straightforward: there was no caveat in the rules that prohibits market manipulation, and there was no caveat that dictated the account had to be down for some minimum amount of time. As such, the fact that the account was deactivated at resolution time is all that matters. Checkmate.

To deviate away from truth-finding would be to embrace corruption and resolutions based entirely on politics - a lot of people predicted Jack would not deactivate the Twitter account - WHY? Why did they feel so confident this would not happen? Why should they get to steal the money of people who saw that Jack was getting ready to deactivate the account? … To vote against the Truth in favor of a political resolution is CORRUPT behavior. It is against the ethos of crypto.

— Anonymous trader

It just seems to me like if the oracle wants to be broadly useful, it should be neutral to the "intended" purpose of any given market, and instead report the reality of what actually happened (and allow things like "fraud" to be considered at the application layer)

— Anonymous trader

The majority of UMA voters felt empowered to decide that the “spirit of the market” in this was violated by the occurrence of a bribe. They ignored the fact that the motivations of Jack Sweeney aren't what the prediction market is supposed to be resolved on, but rather on the status of Jack's ElonJet account.

Here is the only UMA documentation that at first blush supports this “spirit of the market” interpretation:

The key words here are “incorrect data can be disputed.” I am of the mind that ElonJet being down is not “incorrect data,” it is correctly reflecting the state of the world. An example of incorrect data would be a glitch in the Twitter API, not in ElonJet willfully taking his account down.

The majority of UMA voters, however, took this “incorrect data can be disputed” clause to mean that ElonJet being down was “incorrect data '' because it had been rigged. This is a gigantic cope. This market, in my opinion, should clearly have resolved the “Yes, the ElonJet account was deactivated at the deadline.” The rules are based on reality, and the riggers succeeded in changing reality.

UMA has one job as a truth oracle - to resolve markets accurately. They chose not to do so to protect the financial interests of bad predictors.

— Anonymous trader

We can't act as judges to resolve things based on our wisdom. The rules of the game are clear even if they are written poorly and even if the system is manipulated. The only question there is, Was the account active or not active at the time of resolution? And the evidence provided proves it wasn't. So the way I see it, P1 - No (0) seems to be the correct answer if the account was not active at the time. And the evidence presented does confirm that.

— Anonymous trader

The account was clearly deactivated before noon vote P1(0). Plenty of us saw it … He had an explicit price to be paid to shut it down for good, so it is not like him being paid to shut it down is somehow counter to what this market was about. People should take legal action against the scammers if they want, but the oracle should be about accurately reporting on the world, not making ethical/legal judgments on if the resolution is good.

— Anonymous trader

I also have no position in the market. Match fixing is fraud, and should be punished, not rewarded. There are two dangerous outcomes of letting match fixing stand: 1. It damages the integrity of the site. No one can have faith in the fair outcome of markets any longer. What game are we playing here? Who can predict events better or who can cheat better? 2. It invites further chicanery and possibly brings unwanted attention to the site. Think about the PredictIt user who made the news for sending death threats to Andrew Yang in order to prevent him from tweeting. We can't normalize this sort of thing. Vote YES

— Anonymous trader

Vote

The UMA voters resolved this market in favor of “the unwritten spirit of the market” rather than according to a literalist reading of the rules.

Conclusion

What lessons have we learned today?

ElonJet is really stupid & corrupt.

This was a bad market and the Polymarket platform bears responsibility for creating it; regulated markets (e.g. Kalshi) would never allow a market to be created that depends on the whims of a single college student. In fact this market was so bad that most traders weren’t surprised that an easily riggable market was rigged.

Frankly, if the dumbass Polymarket employee who came up with this market had any foresight to prohibit market manipulation, they would have had the brains to simply not put up the market in the first place.

— Anonymous trader

We are still so, so, so early in crypto.

My opinion is that crypto prediction markets won’t be a mature technology for at least 5 more years. Until then, more painful lessons like this will continue to be learned.

Don’t deposit any money on unregulated, offshore prediction markets unless you are comfortably losing all of it on a whim. This is financial advice.

What an interesting article.

There is a reason ancient societies invented things like worry beads. Idle hands 'n all that. I've zero moral objections to gambling; I just think it's dumb; I do understand that all of financial markets on which the world revolves are built on various forms of gambling, in the scheme of things, but...

...I went once to Atlantic City because the now-unhusband wanted to go, and it was one of the saddest things I ever saw, all those people lined up in front of slot machines pulling them levers with essentially blank faces.

This really isn't so different from that.

I enjoy reading everything you write--including this--but it certainly seems like a tawdry, not clever or exciting world. Bad for one's healthy mental development.

Anyway Happy New Year!