Issue #2: CBDC is More Dangerous Than AI

Plus, why Zimbabwe's new gold-backed CBDC is doomed to fail.

Dear readers,

I'm here to own up to my misstep in launching a second newsletter alongside the first one. I'm not going to beat around the bush: it was a dumb move. It doesn’t make sense to grow 2 email lists at once, it makes more sense to have 1 big one. Fragmenting viewership is especially pointless since it’s very likely almost all my readers are the same. After careful consideration, it makes more sense to merge the two newsletters back into the original one. I am going to keep writing the “This Week in CBDC” updates every week, but they will be on Karlstack Crypto, which is what I should have done in the first place.

I thought it made sense to make my new weekly series “opt-in”, but it actually makes more sense to make it “opt-out”. If you don’t care about CBDC, here is a reminder: Karlstack is split up into 5 sections: Economics, Academia, Politics, Crypto and Personal. To opt-out of this “Crypto” section you can click the “Settings” button (at the top right corner of your screen) and then click “Manage Subscriptions.” Thanks for sticking with me through this journey of self-discovery, and I look forward to delivering high-quality content to you in the future.

Chris/Karl

Welcome to Issue #2 of This Week in CBDC, where we're calling out the hypocrisy and deceit of those who claim to have our best interests at heart when it comes to Central Bank Digital Currencies (CBDCs).

News Roundup

April 24: China’s Changshu city to pay civil servant salaries in digital yuan (Yahoo!)

April 27: Ted Cruz “Very Concerned” About CBDCs; Believes China Is Out To Destroy Bitcoin (Dales Report)

April 28: Mauritius planning to launch pilot project for retail digital rupee late this year (Coin Telegraph)

April 28: ECB Mulls Decentralized Settlement for Wholesale Financial Markets (Coindesk)

April 28: Visa to Develop Brazilian Blockchain-powered CBDC Project (Crypto News)

April 29: Why a Bank of Canada digital dollar would put an end to ‘bank run’ crises (Toronto Star)

April 29: House Majority Whip Tom Emmer: Fed Should Play No Role in Developing a Central Bank Digital Currency (Twitter)

April 30: Zimbabwe's De-Dollarization: Central Bank to Issue Gold-Backed Digital Currency in Early May (bitcoin.com)

May 1: More than 110 nations are developing central bank digital currencies, says IMF chief (Twitter)

May 1: Crypto Will Outperform Gold, Real Estate and Stocks As Central Bank Currency Debasement Accelerates: Raoul Pal (Daily Hodl)

Future: Central Bank Digital Currency Consultation closes 7th June (Bank of England)

Substack Spotlight

I googled “Substack CBDC” and this is one of the top articles:

As regular Karlstackreaders would know, I don't like Noah Smith.

The whole point of his article is to downplay the issue — look away, plebes! — the future of money is “not very interesting or useful”! Don’t worry about it! Go back to bickering about how many genders there are, go see the latest Marvel movie. The central bankers have the future of money under control. They know what they’re doing. Trust the experts. Trust the science.

It’s clear that Smith is a shill for CBDCs running cover for an authoritarian nightmare. Those who disagree with him, he suggests, are simply being paranoid. But let's not forget that the power to turn off someone's access to money for "wrongthink" is a very real and frightening possibility. Just ask the Canadian trucker protesters. It’s Noah Smith’s enemies who will need to worry about their money getting turned off.

Smith's main argument is that a CBDC "digital dollar" would be no different from the dollars that exist today, and that it would essentially just be the Fed operating a Venmo/PayPal competitor. While he is not entirely wrong, his omission of any potential downside makes it clear that he is shilling for CBDCs and trying to shove them down our throats. Literally half of his article is dedicated to a section called “Possible benefits of a CBDC”, and then he doesn’t bother to acknowledge a single potential downside? Of course CBDCs are “not very interesting or useful” if you assume no downsides exist! The whole thing that makes them “interesting” is their downside. This is a good example of the evil we are dealing with; as you become enslaved by CBDCs over the next few years, all the mainstream pundits like Noah will tell you the whole time that’s it’s not happening — it’s nothing — it’s not a big deal — okay fine it’s happening but it’s a good thing — don’t worry about it — you’re an extremist if you worry about it — CBDCs are just not very interesting or useful okay? Don’t be a bigot. You’re a terrorist if you oppose CBDCs.

Smith's skewed view of freedom is evident in his recent writings. In 2021, he claimed that vaccines are the key to freedom:

And just a year later he argued that we should be willing to fight World War III to preserve our freedom. It's clear that Smith's definition of freedom is a fluid concept that changes depending on his agenda. I’m 100% positive that he will soon argue CBDCs are good for freedom.

In short, we shouldn't take advice on freedom from someone like Noah Smith, who seems to have a warped view of what it means to be free. Let's not be swayed by his attempts to make us believe that CBDCs are harmless and useless. As we move towards a digital future, we need to be vigilant about protecting our financial freedom and not blindly trust the government to do what's best for us.

Tweet of the Week

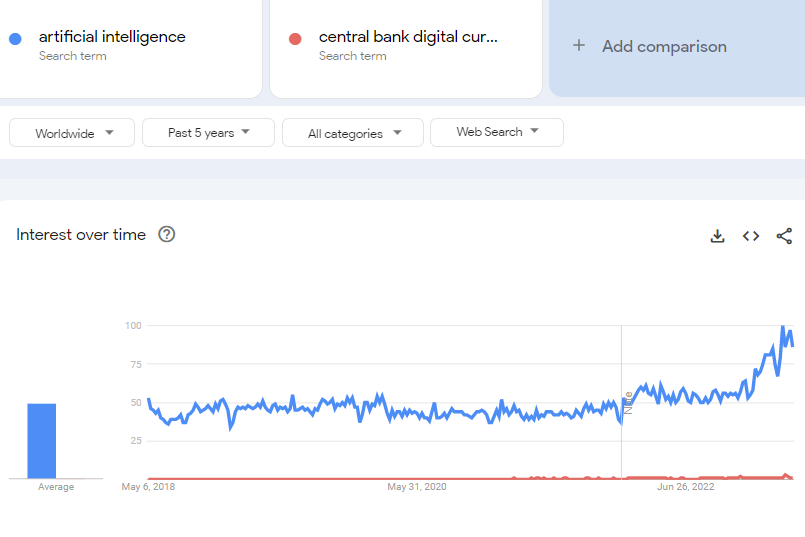

In a recent poll I conducted among my followers, it was revealed that more people were concerned about the risks of CBDCs compared to those of AI.

This is a surprising finding, given that just in terms of Google Trends, CBDC isn’t even 1% popular as AI.

On a related note, I highly recommend subscribing to AI Supremacy. This is not a paid advertisement, but rather a genuine recommendation for a newsletter I personally subscribe to and find valuable.

While there are several prominent organizations dedicated to addressing the risks associated with AI, there is no equivalent support for CBDCs. The Future of Humanity Institute, run by Bostrom, the Future of Life Institute, set up by the MIT physicist Max Tegmark, Elon Musk's OpenAI nonprofit, and the Open Philanthropy Project, part-funded by Facebook founder Dustin Moskovitz, all dedicate huge resources to addressing the risks associated with AI. CBDCs don't have analogous support, only greedy central bankers.

Unlike the existential risk of AI, which could materialize in the short-to-medium term future, with current estimates putting the arrival of AGI as far away as 2031, CBDCs are being implemented right now. It isn’t a hypothetical risk, it’s a risk that is already here. Almost every central bank in the world is getting ready to roll them out, with proof of concepts and pilot programs already deployed, and many already fully launched. There is no stopping them.

The most obvious risk of CBDCs is a loss of privacy and total death of anonymity — they will be used as tools of surveillance and control by governments, it’s just a matter of when (China is already doing it), and to what extent. The whole point of CBDCs is for the government to track every transaction of every citizen; this built-in surveillance & censorship of CBDCs directly threatens democracy by targeting civil rights advocates, political dissidents, whistleblowers, minorities, journalists and ordinary citizens.

“Those calling for the rollout of a CBDC are naïve to believe that this can be done without establishing a centralized surveillance system for all financial transacting. Quite simply, even if such surveillance is not included in the [initial] design, it would be trivial to add it at a later stage. Once a door to surveillance is opened, it is virtually impossible to close.”

NATALIE SMOLENSKI, BITCOIN POLICY INSTITUTE

“In authoritarian societies, central bank money in digital form could become an additional instrument of government control over citizens rather than just a convenient, safe, and stable medium of exchange.”

ESWAR PRASAD, CORNELL

“CBDCs are a nightmare for civil liberties. They put governments at the center of every transaction, giving governments visibility into financial transactions and the ability to revoke money. This is the exact opposite of the purpose of cryptocurrency technology.”

MARTA BELCHER, FILECOIN FOUNDATION

“I can see why China would do it. If they want to monitor every one of your transactions, you could do that with a central bank digital currency. You can’t do that with Venmo. If you want to impose negative interest rates, you could do that with a central bank digital currency. You can’t do that with Venmo. And if you want to directly tax customer accounts, you could do that with a central bank digital currency. You can’t do that with Venmo.

I get why China would be interested. Why would the American people be for that?”

FEDERAL RESERVE BANK OF MINNEAPOLIS PRESIDENT NEEL KASHKARI

CBDCs are the end of free speech. If you say something the government disagrees with, they will turn your money off. Noah Smith wants to turn your money off if you disagree with him. I promise you, he does. CBDCs will do untold damage in the hands of people like Noah Smith, who run the central banks. In addition to turning your money off whenever they want, they will have the ability to burn your money, make your money expire (you are literally prevented from saving and potentially exiting the rat race), impose direct haircuts on it, repossess it for whatever reason they want (e.g. social credit, carbon credit, money with expiration date, location-based restrictions, wealth tax), whenever they want. There is no limit to the level of control that the government could exert over people, there are no guardrails on this thing. It’s going to turn you into a slave. With CBDC, your money isn’t really your money; your property rights are subservient to the “public good” — there are no property rights — IT’S COMMUNISM.

Your spending would be completely restricted to whatever the current ruling regime decides is acceptable. Want to treat yourself to a steak once in awhile? Too bad, it’s not environmentally friendly. Need to take a flight to see a sick loved one? Too bad, you’ve exceeded your carbon limit for the month. Feeling unsafe in your neighborhood and decide to buy a firearm for protection? That can be denied too, because the Federal Reserve is a private institution and is not restrained by the 2nd amendment.

Meme of the Week

Country Corner: Zimbabwe

Zimbabwe is a failed state.

In a desperate move to address some of their many issues, the Reserve Bank of Zimbabwe is set to introduce a gold-backed digital currency on May 8, 2023… This week!

While the idea of a gold-backed digital currency may sound exciting, it won’t fix anything — just look at their GDP per capita, which has been hovering around $1,000 per year for about 30 years now.

This isn’t a fiat currency problem, this is a human capital problem.

The average IQ in Zimbabwe is 74.

When the term “retarded” was still used by medical doctors, more than 30 years ago, IQ scores between 70 and 79 were classified in the borderline mentally retarded range. This means that mote than half of the country of Zimbabwe would fall under the bellcurve as borderline mentally retarded under these old standards, with millions more classified as “severely retarded.”

It’s really, really hard to manage a modern, thriving economy when literally half your population is retarded and 11% of all adults have AIDS. I am not saying all of this to be cruel…. it’s just the sad reality: IQ is the main thing holding Africa back, and sticking your head in the sand and ignoring it won’t change the reality.

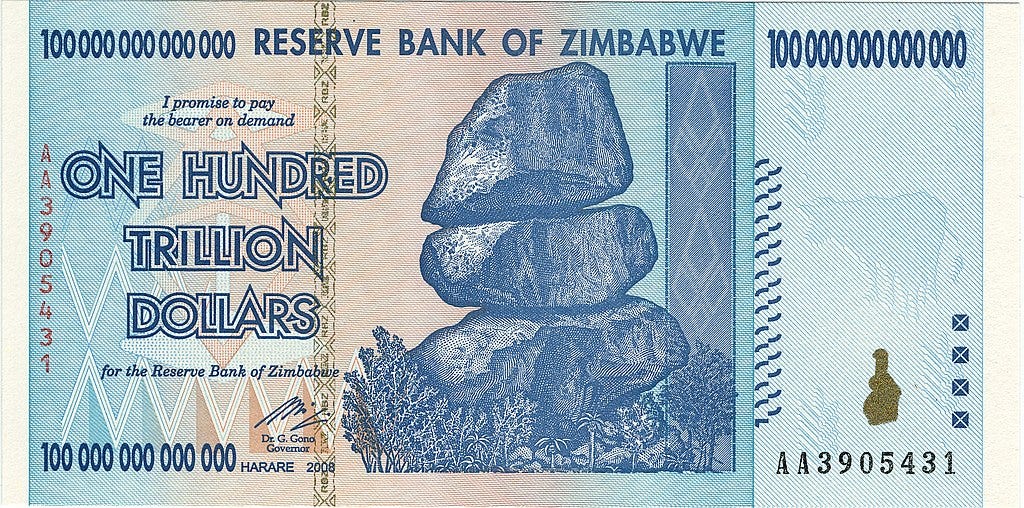

With an average IQ of 74, is it any wonder that the country suffers chronic hyperinflation? Everyone knows the stories from 2008 about the wheelbarrows full of cash, and the government printing 100 trillion dollar notes, etc.

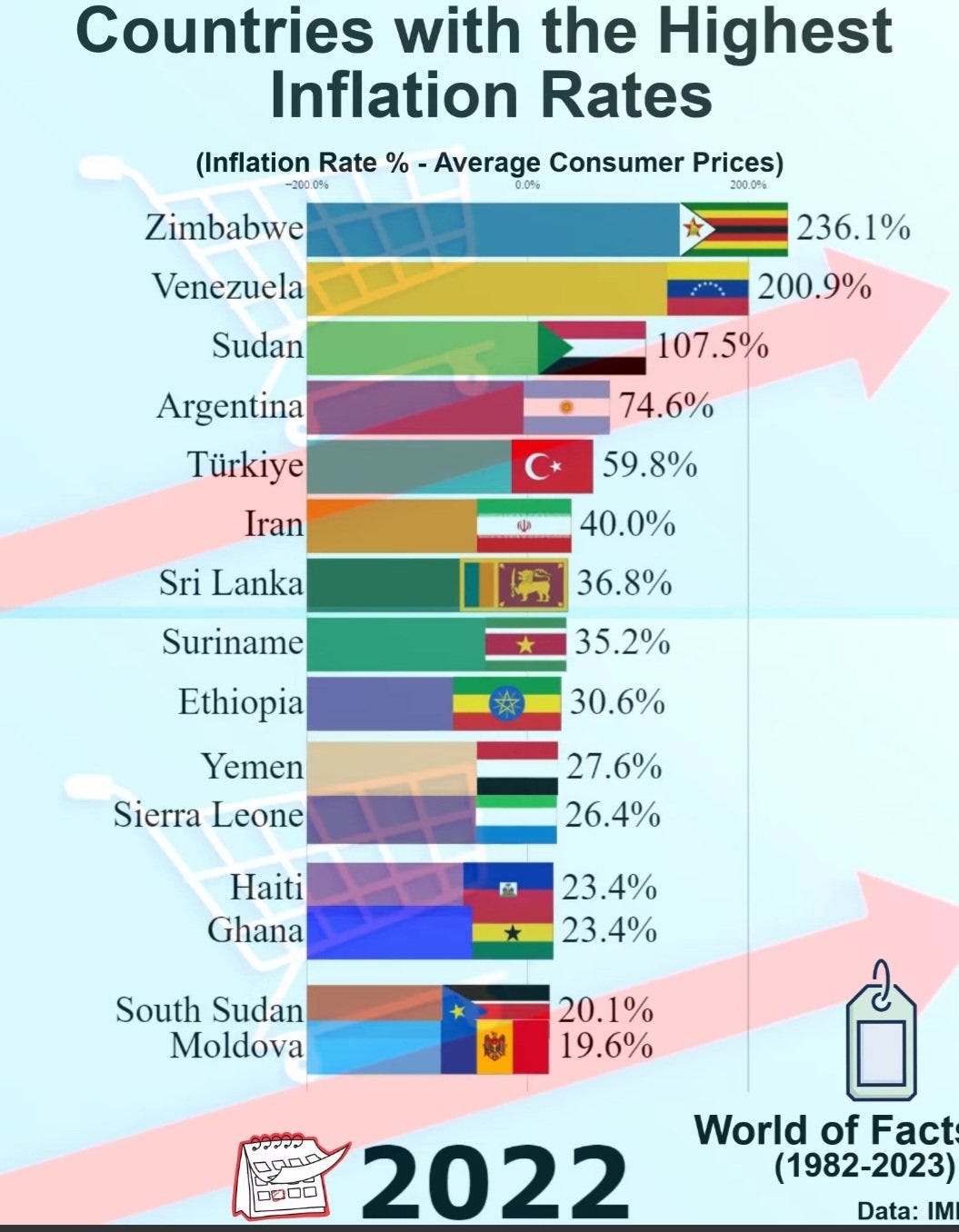

The macroeconomic situation in Zimbabwe in 2022 is as dire as ever. The inflation rate reached a staggering 417.25% in October 2020 before marginally improving to 236% in 2022, still the highest in the world.

To put it in perspective, just 12 months ago, one US dollar would have netted you around 150 Zim dollars. Today, you would need nearly 1,000 Zim dollars to make the same exchange.

Reserve Bank of Zimbabwe Governor John Mangudya said the exchange rate volatility has been caused by “expectations of increased foreign currency supply” due to “the tobacco season”. Okay. The reason this chart looks so weird (see that square block?) is that the government relaunched the Zimbabwean dollar in 2019 after a decade of dollarisation, and, well, you can see how that went. In 2019 the entire country actually used the new Zimbabwe dollar, but then quickly switched back to US dollars.

The failure of the Zimbabwean dollar, coupled with the world's highest inflation, has left the country in dire straits. With no other options, they are grasping at straws and hoping that a gold-backed CBDC will provide a solution. However, I remain skeptical that this will work. Zimbabwe's fundamental issues with corruption and lack of human capital cannot be fixed by tinkering with their currency. Unfortunately, Zimbabwe has a track record of turning everything they touch into garbage, and I fear this will be no exception.

Moreover, the only other attempt at a CBDC in Africa was a dismal failure. Nigeria launched its eNaira in October 2021, but a year later, less than 0.5% of Nigerians were using it, according to Bloomberg. By August 2022, the eNaira had only been used for transactions worth $9.3 million. Given this track record, it is hard to imagine that Zimbabwe's gold-backed CBDC will fare any better.

I don’t see any reason why Zimbabwe’s attempt will fare better than Nigeria’s.

The lack of transparency surrounding the technical details of the CBDC is also concerning, with no documentation, math, or code provided to back up the vague promise of a "gold-backed token." This has SHITCOIN written all over it.

Here is the entire documentation:

In the end, this is another example of a developing country butchering the potential of crypto. While some may believe that "gold on a blockchain" is a solution, the need to trust another party ultimately undermines the trustless nature of cryptocurrencies. The whole point of crypto is that it is supposed to be trustless, which is why Bitcoin remains a better option for those seeking a decentralized and transparent monetary system.

I hate to say this, because I do like Noah, but I have not read much of him since he reposted that CBDC article from last year (that I had not previously seen). Kind of regret becoming a paid subscriber of him now.

I agree with your conclusion. I that it were easier to fit the following physical objection to specific applications of A.I. more easily, but hopefully this helps with additional perspective. There are inherent limits to the complexity that A.I. can handle (and that's a good thing for humanity).

https://roundingtheearth.substack.com/p/monkeys-typing-shakespeare-the-impossible