Issue #3: Canada Forges Ahead with CBDC While Florida, Texas & North Carolina Ban It

Welcome to Issue #3!

News Roundup

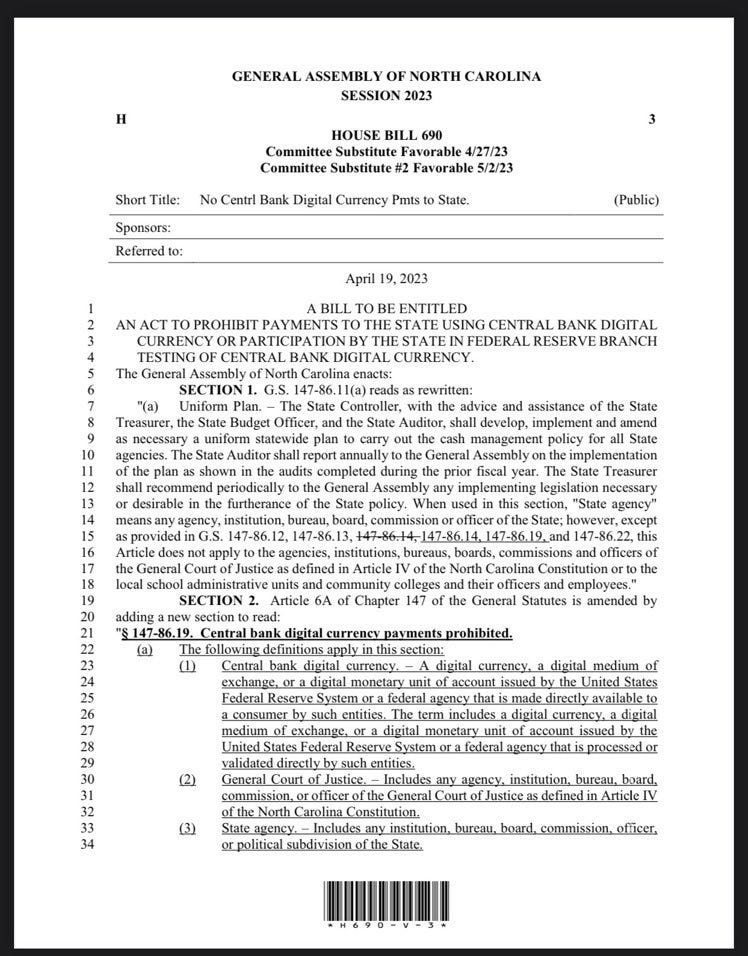

May 4: North Carolina House passes bill banning CBDC payments to the state (Coin Telegraph)

May 5: BNP Paribas Will Link Digital Yuan to Bank Accounts for Promoting CBDC Use: Report (CoinDesk)

May 8: Bank of Canada launches public consultations on digital C$ (Reuters)

May 8: The Future of Central Bank Digital Currency (Ripple)

May 9: Brazil Central Bank CBDC Pilot Snubs Crypto Firms (CryptoNews)

May 9: Stablecoins and digital assets unlikely to replace central bank money: Moody’s (Coingeek)

May 10: Hungarian Central Bank Sees No Imminent Need for e-Forint (Coindesk)

May 10: Reserve Bank of India’s deputy governor wants to promote CBDCs (CoinGeek)

May 10: 'Cash Is Independence': Ron DeSantis Slams the Government's Plan for Centrally-Controlled Digital Money (Reason)

May 11: BIS Tackles Complexities of Offline CBDC Implementation in New Handbook (Blockworks)

May 11: Project Polaris: BIS explores offline-operating CBDCs (Finbold)

May 11: Statement on proposals for a Canadian central bank digital currency (Justice Centre for Constitutional Freedoms)

May 11: CBDC: European banking regulator says current banking model not working (Ledger Insights)

May 12: Texas Introduces Bill to Ban Central Bank Digital Currency (Guru)

May 12: Zimbabwe's central bank launches digital currency backed by physical gold (Business Insider)

May 12: Governor DeSantis signs ban on central bank digital currency (Fox)

May 13: China's digital currency raises concern as wages of thousands of public servants moves to e-CNY (ABC.net)

Substack Spotlight

Because our government and The Federal Reserve has decided to impose this top-down, anti-market “solution” to the banking contagion *that their policies created*, these forces have expedited the path towards an increasingly centralized economic structure modeled after the World Economic Forum’s feudalistic “stakeholder capitalism” system. Similar to the U.K’s “Britcoin” Central Bank Digital Currency (CBDC) project, America’s coming public-private CBDC system will bring the Big Banks into the fold as partners to its technocratic monetary tyranny.

“First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.”

A CBDC system will grant enormous additional power to the government and their oligarch partners. It allows for this ruling class to assert easier control over the population’s spending, saving, investing, and borrowing power. The far-left Keynesian economists and monetary theorists who populate America’s “elite” institutions believe these tyrannical and restrictive policies will help bring about economic utopia. However, reality tells us that implementation of this CBDC project will not only amount to a semi-permanent financial hellscape, but will also be disastrous for prosperity in America.

The public-private CBDC threat is now becoming more real than ever before, as the Great Bank Nationalization era arrives at our doorstep sooner than we all anticipated.

Tweet of the Week

Meme of the Week

Sponsor of the Week

This week’s issue is sponsored by Stat Significant a weekly newsletter featuring data-centric essays about culture, economics, sports, statistics, and more.

Country Corner: Canada

The Bank of Canada (BoC) initiated a public consultation for a Canadian Central Bank Digital Currency on May 8th.

Here is a BoC video explaining the “digital loonie”:

In a classic passive-aggressive Canadian twist, the BoC has launched this campaign to gather insights from as many Canadians as humanly possible... all while conveniently disabling the comments section of their video. They sure know how to embrace the spirit of democracy, eh?

This is exactly how the Canadian government rolls. They put on a show of seeking public input, but in the end, they don’t care about feedback.

Take last week's incident as a prime example. The city of Guelph, Ontario caused quite the stir on Twitter. They made grand gestures about wanting to hear from you, eager to collect feedback, but while soliciting feedback they turned off the comments to their tweet. The irony is almost too Canadian to handle.

Note that this tweet has 0 replies but 978 mocking QTs.

If you dont restrict comments on your YouTube video, like this video from this week doesn’t…

Your comments section will look like THIS:

That was a conservative YouTube channel, though, so of course the comments are going to be against CBDC.

Liberals love CBD, right?

Surprisingly, no, actually.

Canadian Redditors seem to hate CBDC, which is surprising because Canadian Redditors are as bleeding-heart soyboy as you can get.

While researching today’s article I came across a CBC News article from yesterday titled Does Canada really need a digital loonie? — I was shocked to see that it has thousands of comments:

Just as Canadian redditors tend to lean towards supporting the Liberal/NDP parties, an even more pronounced bias can be observed among CBC News readers; trust me, CBC readers are as shitlib as they get; these people are the polar opposite of right-wing extremists. I will end this article by giving these shitlibs the last word; their combined outrage shows that maybe there is hope for Canada yet… but probably not. If the Bank of Canada refuses to genuinely listen to Canadian voices, Karlstack will step up to elevate them.

I encourage you to go directly to the CBC News article, Does Canada really need a digital loonie?, scroll down to the comments sections, and then sort by “most liked” — thousands of these comments, and NONE of them want CBDC.

It's quite possible that the CBC article on CBDCs attracted a disproportionate fraction of more right wing commenters due to the subject matter. Most people I've talked to still haven't heard of CBDCs. That said when I explain it to them, people generally react with a hard no.

I'm surprised the government hasn't already astroturfed pressure groups to demand CBDCs be implemented in the name of refugee justice or whatever. Maybe they just don't care at this point. It's not like Canadians can do much, at least through the channels of electoral politics.