The Crucifixion of Avraham Eisenberg

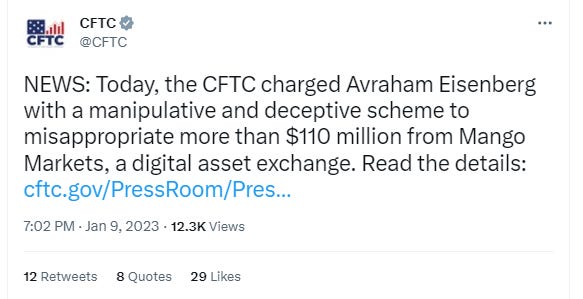

The US Government (CFTC, SEC, & DOJ) are using Avraham as a landmark case to establish the precedent that DAOs are legally binding legal contracts & that tokens are securities (or maybe commodities)

When Karlstack doxxed Avraham Eisenberg 6 months ago…

I didn’t really expect it would bring the full force of the FBI, CFTC, SEC, DOJ, and US District Court for the Southern District of New York crashing down upon him.

Avraham is now facing decades behind bars.

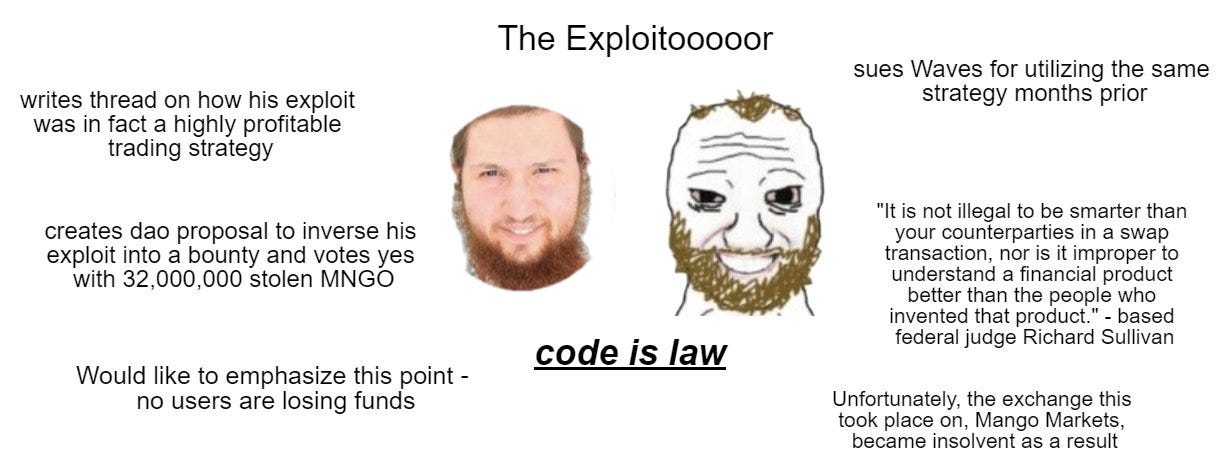

In today’s article, I will dive into each of Avi’s numerous legal battles, many of which have wider implications for the nascent crypto legal landscape. Eisenberg's case marks a pivotal moment as he is the first individual to be incarcerated for exploiting a decentralized platform and/or manipulating a smart contract.

This is the first case in which the CFTC has charged a person for fraud in connection with “oracle manipulation” on a decentralized exchange.

Avraham’s legal saga will establish whether code equates to law, whether DAO votes are legally binding contracts, and whether tokens are securities or commodities.

Today’s issue of Karlstack is sponsored by The Digital Asset Investor Newsletter

Each week, Richard Patey breaks down the most interesting digital asset news stories and opportunities plus what he's personally buying (or selling). Content sites, domains, newsletters, NFTs and more...

I get paid $4.13 for everyone who clicks on this button — so if you click this link, you are sending me a $4 tip, basically. Plus it is a legit crypto newsletter if you are trying to stay up to date on NFTs and crypto, obviously. I subscribed myself.

But First, Every Villain Has an Origin Story

Every good villain needs a backstory, and Avi fits the bill. This 27-year-old from New York is a coding, trading, and hacking genius, with an IQ in the 99.99th percentile. Plus, he's got that extra edge of being on the autism spectrum.

He dropped out of high school as a teenager because he was viciously bullied.

"The child who is not embraced by the village will burn it down to feel its warmth".

— African proverb

Bypassing highschool, Avi went to the library and got his GED instead, and made money by selling candy to the teens who had to go to school; he lent them candy on credit.

After obtaining his GED, he attended Yeshiva University, a private Orthodox Jewish university, where he obtained a bachelor’s degree in math in 2019. I had never heard of Yeshiva before, but Wikipedia tells me it is over 137 years old and has an endowment of nearly $1 billion dollars. While an undergrad, Avi was “a member of the debate team and occasionally wrote for the school paper. In what appears to be ironic foreshadowing, Avi listed his intellectual interests on a Yeshiva profile as "epistemology," "philosophy of science," and "applied ethics”. He also likes chess, here is his profile with 4500 games played.

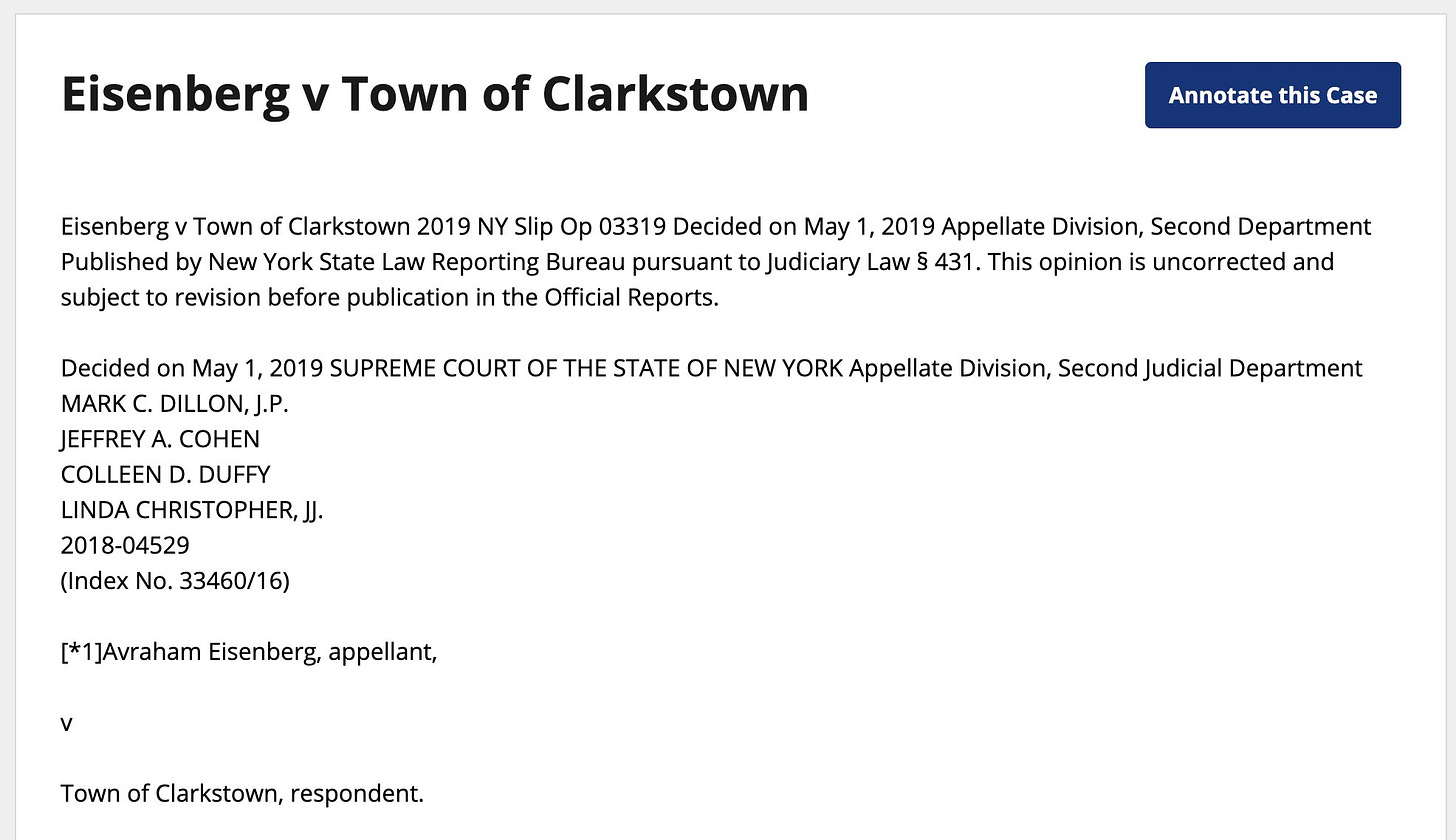

While an undergrad at Yeshiva, Avi slipped and fell on some ice. Allegedly. He sued the town of Clarkstown, New York (population of 86,329) for this slip-and-fall.

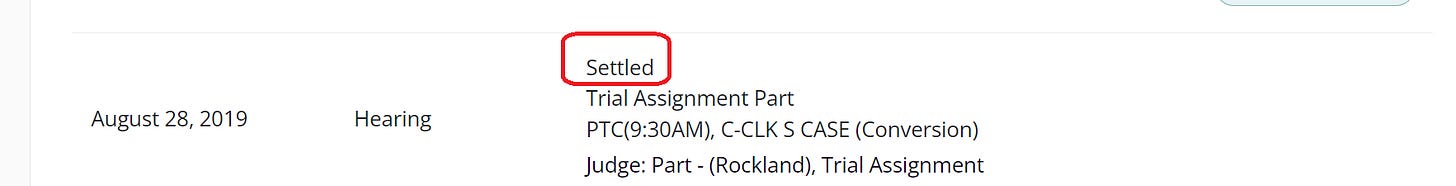

says that " his personal injury case [against the town of Clarkston, NY] was eventually discontinued with prejudice in 2019. "I am pretty sure this analysis is wrong. Yes, the lawsuit was originally dismissed with prejudice, but later Avi appealed and dragged it all the way to the Supreme Court of New York, where the dismissal was overturned. The case was settled in August 2019 for an unknown amount.

After his slip-and-fall lawsuit, Avi tried his hand at running a dropshipping company on Amazon for three years. But, as luck would have it, his company found itself knee-deep in legal trouble when a Chinese firm sued him for selling counterfeit goods in 2020. The Chinese firm won the initial lawsuit, and Avi was banned from selling on Amazon.

Like a phoenix rising from the ashes, Avi refused to accept defeat and appealed the decision all the way up to the 9th Circuit Court of Appeals. And would you believe it? He actually won the appeal! Just like he won the appeal against Clarkstown, NY. The court ruled that Avi was selling legitimate merchandise and didn't commit any counterfeit crime.

Unfortunately, this victory came a little too late for poor Avi. Despite the court's ruling, Amazon refused to lift the lifetime ban they'd imposed on him. Avi lamented on Twitter, "It would have likely continued to grow rapidly, but it was viciously [attacked] by a competitor upset about our lower prices and shut down...I gave the building path a fair shot and got told by the system not to bother."

Avi had to slink away from the dropshipping business with his tail between his legs, but not before pocketing hundreds of thousands, or maybe even millions, of dollars in profit. Court documents from the counterfeit goods lawsuit showed that Avi's business was wildly profitable, earning a whopping $300,000 in just a six-month span in 2019. "My first company grew to about a $5M run rate selling goods online," he boasted.

After the slip-and-fall and dropshipping debacles, Avi decided to ditch the physical world altogether and spend the next few years glued to a computer screen, growing his pile of cash into a bigger pile by trading, hacking, scheming, plotting, scamming, exploiting, and manipulating various coins, tokens, protocols, markets, derivatives, stocks, and ponzi schemes.

What's frustrating is that Avi was actually a talented guy. He didn't need to cheat to make millions. He could have easily gone to work for a hedge fund on Wall Street and played by the rules.

Case in point, Avraham is the 3rd most profitable trader in the history of PolyMarket. When you sort by PnL on Polmarket Whales it shows that he has made $350,000+ in the last couple years just by predicting the future accurately, sans cheating. And if that wasn't enough to stroke his ego, Avi even created his own Substack account in July 2021 to brag about his "risk-free" crypto gains.

His big break came in February 2022 when he leveraged the pile of cash he had built to extract $14 million from FortressDAO. Word on the street is that the CFTC is currently investigating his involvement with FortressDAO, but of course, Karlstack broke the story first.

One court document footnote gives credit to Karlstack:

Avi used this $14 million of capital acquired from FortressDAO to buy and sell large positions to manipulate Mango Markets; that’s how he stole the $100+ million dollars, by risking millions of his own dollars that he had built up from slip and fall settlement --> counterfeit Amazon dropshipping -- > dominate PolyMarket --> FortressDAO rug --> Mango Markets. I am sure I am missing dozens of other schemes. So there you have it, folks. The incredible story of how a kid from New York went from selling candy bars on credit in high school to becoming a mastermind thief in the world of crypto and stealing $100+ million dollars.

Despite his enormous wealth, Avi lives like a monk, or maybe even more frugally than a monk. He moved to Puerto Rico just to avoid taxes and doesn't even own a car because he's too cheap to pay for gas. He’s not really in it for the money, I don’t think. But why risk everything just for the thrill of it? Maybe he's a mad scientist, pushing the boundaries of what's possible just to see how far he can go. Or maybe he's just bored and disaffected and edgy, trying to make a name for himself in a world that doesn't understand him. He seemed to enjoy his twitter followers more than he enjoyed his $100 million dollars.

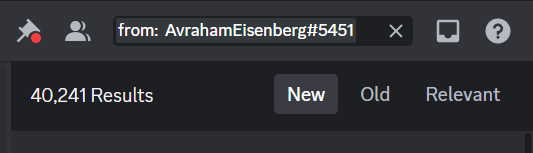

How do I know all this? How can I guess at his deepest motivations? Well, I actually know Avi pretty well — you might even call me the world’s foremost Avraham Eisenberg expert, since he doesn’t really have any friends. Friends is a strong word for our relationship, I would call it frenemies, since I have written 5 articles about his exploits and I have hung out with him in a Discord server for 2 years, where I observed him in his natural habitat. Here is a link to that Discord server:

If you join and search “Avi” you can even read all 40,000+ of his messages.

You will find such gems as:

A reminder to anyone in this chat whomst this message may concern: you can just commit more crimes. You don't have to stop, out of fear of the consequences.

good morning fellow gay felons

Gm fellow people who love to do crimes over the interstate wires

Gm fellow felons and Seychelles entities

good morning fellow felons

Gm fellow felons

be gay do crimes

I had steak with Peter Thiel the other month … Thiel told us that when Trump wins they're going after Gates as a Chinese asset … Peter Thiel told me tether CEO is a criminal … Thiel is the only billionaire that has had success suing people that said annoying things about him

The death penalty is more humane than prison

time to sue the blockchain

time to do a lil insider trading

can I sue

I should sue them

Im gonna sue them

should I sue them

time to sue

if I had more time I'd sue

if you don't sue them after they sue me I will sue you for not suing them for suing me

time to … sue

the best people to sue are those with lots of money you can seize but who won't respond in court

Time to sue vapesters

who do I sue

I'm gonna sue kalshi to recover my ftx funds

Wait you're telling me this isn't legal?

Very legal and very cool

We should … sue

I would sue if I had time

How do I sue

you can't sue an idea

You should sue

sue me

They need to sue starlink

they should sue the marketwatch guy

I should sue just to find out

you should sue

Should I sue opensea

All you need is one of the victims to sue

time to sue Jason Stone?

well if I sue and nobody else does

Oh nice I want to sue FTX

Should I sue on behalf of labor laws

Might sue for declaratory judgement on that

guys I need to sue more people

What if we sued God

I'm better at suing people

suing as a jew is very encouraged

if you don't sue them after they sue me I will sue you for not suing them for suing me

I've been manipulating … markets since 2014

the trick to suing is finding a counterparty that can afford a judgement

I'm suing them

I feel like I'm not suing enough people

who hasn't been sued civilly tbh

hey it me I sued the goberment

Should I … sue citadel

I might be suing him for unrelated events soon

Scamming people … is good and based

I should sue Celsius

my advice: find someone that's harmed you and sue them for cash moneys

maybe I should buy up tokens and sue

It's called we do a lil scamming

It's gonna be funny in like a year when I win all my lawsuits

I love reading lawsuits

lawsuits incredibly +EV if you know what you're doing like me

Nice thing about wire fraud is it has a much shorter statute of limitations than rape

Don't let being literally incarcerated stop you from doing a lil fraud

Stealing is such a harsh word, I haven't done that since I was a kid and wanted some gum

What's the new scam? As a scam enthusiast I'd like to know

ur honor I was violating the security laws ironically

Ok who wanna do a lil criming

More women should dabble in the criminal arts

How do we get more womxn into the criminal arts

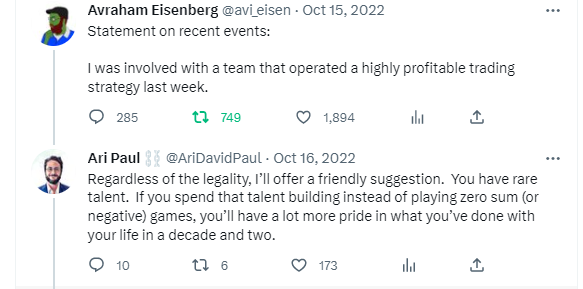

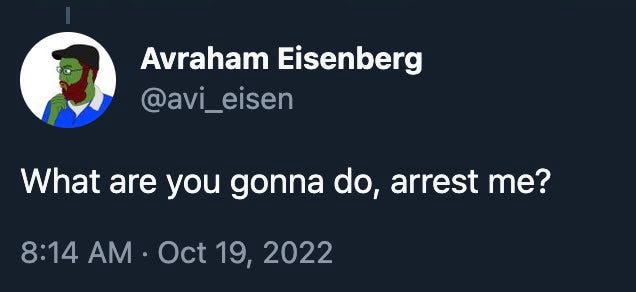

His big mouth and flashy style is what got him caught, honestly. If only he had kept quiet and refrained from bragging about his schemes on Discord, he could've made off with a cool $100+ million. But no, he just had to be a Twitter celebrity, didn't he?

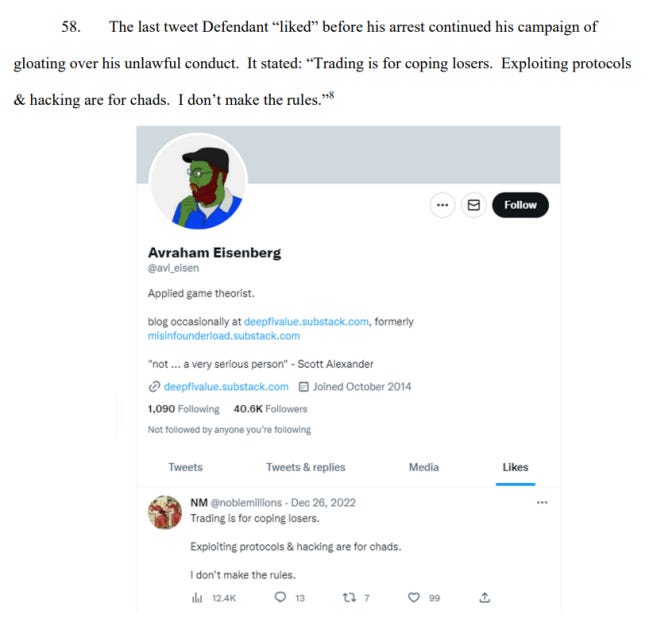

Just look at this excerpt from an official court document:

That’s where his autism comes in. He’s a genius, but he is very stupid.

He had gotten away! He pulled it off! He successfully fled to Israel with 100+ million dollars — he fled the country the day I doxxed him, which is probably why he was denied bail, he’s a flight risk — and was living in Israel for several months before, for some inexplicable reason, he flew back to US territory, at which point he was arrested by the FBI. One of the all time stupid miscalculations.

Now he's up to his eyeballs in at least four court cases.

Let's walk through each one, shall we?

Avraham Eisenberg vs. Mango Labs

This first civil suit is the least of Avi’s problems, because losing this suit would just mean losing some of his millions, but at least he gets to keep his freedom.

When Mango and Avi went to court in March 2023, just last month, Avi kicked Mango’s ass, or at least that is what it seemed like according to a veteran court reporter in New York City who sat through the Eisenberg trial (no cameras allowed, sadly) and livetweeted it.

The most shocking part of the verdict, in my opinion, was that the judge ruled duress did not apply. Wow.

I got it wrong. I guess my amateur lawyer skills aren’t what I thought they were.

What I predicted in my initial article: “Basically what we have here is Avi successfully robbing a jewelry store and then smirking, pointing a gun at the owner and saying, I’ll return half the jewelry if you agree not to press charges. This “agreement” between Mango Markets and Eisenberg is especially non-binding because not only was it agreed to under duress.”

Here is what the judge had to say about duress:

Judge Liman: Can the settlement be voided as the product of duress? No - the token holders rejected an initial proposal. They exercised their free will. And it was later ratified, constructively.

…

Eisenberg's alleged use of a Ukrainian woman's identity does not change the duress.

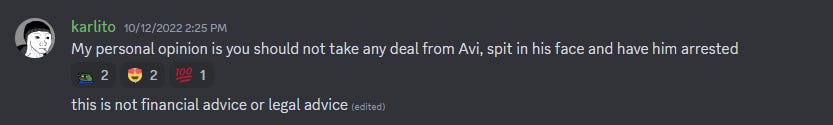

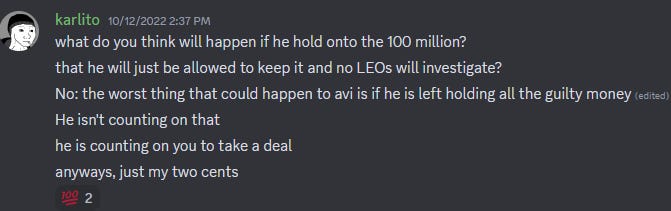

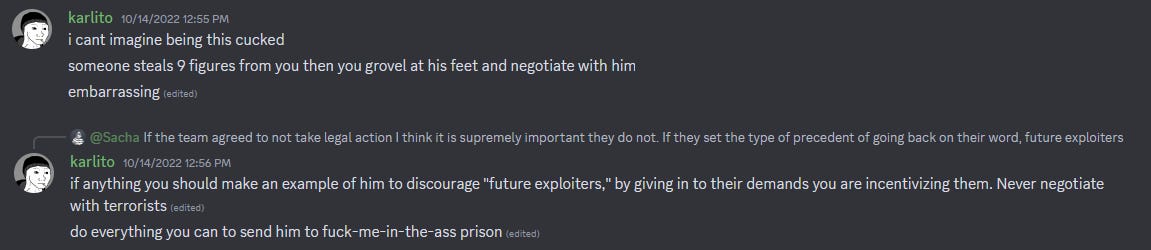

Duress is dismissed as an argument because Mango negotiated with Avraham and cut a deal with him. Too bad. If only Mango had listened to me as this negotiation was playing out in real time when I barged into their Discord server like a crazy person and told them not to negotiate with the terrorist holding them hostage under duress!

If Mango leadership had “spit in Avi’s face” and refused to negotiate with him (as I advised) they would have successfully been able to argue that duress applies, but they didn’t, so they can’t. They panicked and chose to negotiate with Avi, and in doing so shot themselves in the foot and dug their own grave. In the end, they only have themselves to blame. Watching this happen, for me, was like watching a train wreck in slow motion, but instead of being a bystander, Mango’s crappy lawyers are the ones driving the train.

On top of this dumb decision to negotiate with the terrorist, after they negotiated with him, they sat around for 3 months with their thumb up their ass instead of suing him immediately. When asked by the judge to explain this three month delay, they did not have an answer, which was apparently reason enough to deny the motion because it indicates “no true urgency” and no “irreparable hurt”.

Judge Liman: Here, Mango Labs waited more than three months after the Settlement and Release Agreement was entered before seeking a preliminary injunction. Notably the Complaint and Preliminary Injunction Motion are silent as to the reason for the delay. These facts alone warrant denial of the Motion.

It is no surprise that Mango lost what looked like a very winnable case, since in their opening argument, Mangos’s crappy lawyers made a glaring typo, which I have circled.

Avi’s winning argument, in contrast, had no typos, and boiled down to five main points:

Plaintiff Fails to Establish a Likelihood of Success on The Merits

The Facts Omitted by Mango Labs Confirms There Was No Duress

Mango Labs’ Fails to Establish Irreparable Harm

Mango Labs’ Delay in Seeking a Preliminary Injunction Confirms that there is No Irreparable Harm

The Public Interest Is Not Served by Voiding Negotiated Settlements

Avi finishes his argument by demanding that in order for Mango Labs to be allowed to sue him for the $45 million that he took from them, Mangolabs must put up a $45 million bond, which he knows they don’t have, because he just took it from them.

Mango Labs never ended up needing to put up this $45 million dollar bond, though, because their case was dead before it even got to that stage. The judge ruled:

The settlement agreement with Mango DAO does not preclude Mango Labs' standing. NY law applies here. On the preliminary injuction factors, I find plaintiff has NOT shown a likelihood of success on the merits.

Wow — this is a major win for the “code is law” camp — the judge is saying the settlement where Avi repaid a portion of the Mango exploit was legitimate because it was accepted by the DAO.

This settles it… DAO votes are now law.

Amazingly, Avi somehow walks away from this civil lawsuit with $45 million still in his pocket, which a court has now ruled is legally his money.

One lawsuit down, three to go.

Avraham Eisenberg vs. CFTC

After being arrested by the FBI on December 27th, on January 2nd Avi was charged with the CFTC’s “ first enforcement action for a fraudulent or manipulative scheme involving trading on a decentralized digital asset platform and its first involving an oracle manipulation scheme”.

The CFTC will use all available enforcement tools to aggressively pursue fraud and manipulation regardless of the technology that is utilized. The CEA prohibits deception and swap manipulation, whether on a registered swap execution facility or on a decentralized blockchain-based trading platform.

—Gretchen Lowe, Acting Director and Chief Counsel of the Division of Enforcement at the Commodity Futures Trading Commission

The CFTC is charging Avi with 4 specific violations:

The CFTC alleges that the MNGO-USDC swaps meet the definition of “swaps” under 7 U.S.C. § 1a(47) and 17 C.F.R. § 1.3 and are thus are subject to Commodity Exchange Act

Section 6(c)(3), 6(c)(1) and Regulation 180.2 of the Commodity Exchange Act.

Regulation 180.1(a) for manipulative or fraudulent conduct

Section 9(a)(2) of the the Commodity Exchange Act

“This is a novel prosecution involving very complex facts,” said Brian Klein, a lawyer with Waymaker LLP who represents Mr. Eisenberg. “Mr. Eisenberg looks forward to his day in court.”

Avi is currently sitting in a jail cell in New Jersey waiting for his day in court.

Avraham Eisenberg vs. SEC

The next shoe to drop was the SEC announcing charges of fraud, manipulation, and wire fraud on January 20th.

As we allege, Eisenberg engaged in a manipulative and deceptive scheme to artificially inflate the price of the MNGO token, which was purchased and sold as a crypto asset security, in order to borrow and then withdraw nearly all available assets from Mango Markets, which left the platform at a deficit when the security price returned to its pre-manipulation level … As our action shows, the SEC remains committed to rooting out market manipulation, regardless of the type of security involved.

— David Hirsch, Chief of the SEC’s Crypto Assets and Cyber Unit

It should be noted that the charging document gives a shoutout to Karlstack’s reporting:

The SEC is seeking 4 penalties:

Permanently enjoining Avi from engaging in acts, practices, and courses of business alleged herein.

Ordering him to disgorge his ill-gotten gains.

Imposing civil money penalties on him pursuant.

Permanently enjoining Eisenberg from participating, directly or indirectly, in the purchase, offer, or sale of any security.

So, it seems like they want to claw back all the money he took, then claw back some extra as a punishment, and then ban him from trading for life.

Seems fair enough.

The much bigger deal here is that this SEC complaint details how the Mango token passes the Howey Test, so they call Mango a security… which is in direct conflict with the CFTC calling Mango a commodity earlier.

In reaching its conclusion, the SEC relied on the test articulated in the Supreme Court case SEC v. W.J. Howey Co. (referred to as the Howey test), in which the Court found that an investment contract exists where the following prongs are satisfied: the purchaser (1) invested money (2) in a common enterprise (3) with a reasonable expectation of profits to be derived from the managerial or entrepreneurial efforts of others.

The SEC determined that Mango Markets users’ purchase of MNGO with USDC was an investment of money, thereby satisfying the first Howey prong. The SEC averred that there is a common enterprise and that the second prong was satisfied because (1) the price of the tokens moved together “so that each investor profited or suffered losses pro rata based on the ownership share of MNGO tokens,” and (2) Mango Markets “touted that the proceeds of the MNGO token sales would be pooled and used indiscriminately to pursue MNGO’s projects” rather than “divided into subaccounts for sub groups of MNGO token investors.” The complaint also indicates the SEC’s position that the issuance of 5% of the total MNGO token supply to Mango Markets’ 10 creators supports its allegation that the scheme was a common enterprise.

The SEC will gain more power if tokens are classified as securities, and the CFTC will gain more power if tokens are classified as commodities, so I am getting the impression that the CFTC and SEC are in a power struggle with Avi caught in the middle.

Can a token be both a security and a commodity at the same time? Nobody really knows, this is evolving crypto case law, which is what makes this case so important.

I think that Avi has a strong case to argue here that it’s bullshit that he is being charged with both commodities and security fraud. Even if it is unfair, I guess the lesson here is that if you fuck around with crypto and steal $100+ million dollars, expect to get fucked back by Uncle Sam from every angle, even if the way in which you are fucked is slightly incoherent, it will still be brutal.

I think the likely outcome in this SEC case is that Avi pays a huge fine and is banned from trading for life. There is a chance he somehow magically takes the SEC to court and proves that Mango is not a security — THAT would really be groundbreaking, because it would fly in the face of Gensler’s “everything other than Bitcoin is a security” thesis. If anyone can magically beat the SEC and re-define the definition of what a security is, it’s Avraham.

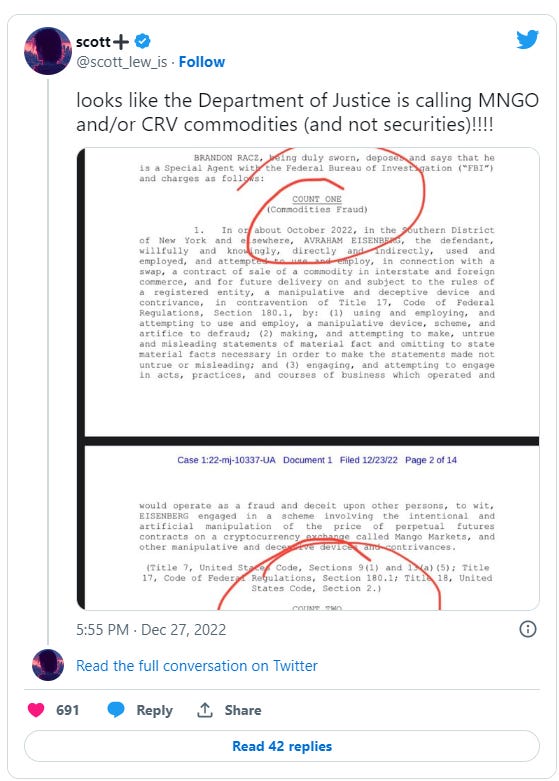

Avraham Eisenberg vs. DOJ

The next domino to fall, after the CFTC and SEC, was the DOJ on February 2nd, 2023.

U.S. Attorney Damian Williams said: “As alleged, Avraham Eisenberg manipulated the Mango Markets cryptocurrency exchange in order to obtain over $100 million in illicit profits for himself. Through his scheme, Eisenberg left others holding the bag. Market manipulation is illegal in all of its forms, and this Office is committed to prosecuting such schemes wherever they occur – including in the cryptocurrency markets.”

Assistant Attorney General Kenneth A. Polite, Jr. said: “Exploiting decentralized finance platforms is the new frontier of old school financial crimes in which criminals abuse emerging technologies for their own personal gain. With this prosecution, the Criminal Division is sending the message that no matter the mechanism used to commit market manipulation and fraud, we will work to hold those responsible to account.”

FBI Assistant Director Michael J. Driscoll said: “The defendant is alleged to have executed a scheme through which he fraudulently acquired over $100 million worth of cryptocurrency. The FBI is dedicated to safeguarding the integrity of all financial markets and will ensure any individual willing to exploit one be held responsible in the criminal justice system.”

The three DOJ charges are:

Commodities fraud, which carries a maximum sentence of 10 years in prison.

Commodities manipulation, which carries a maximum sentence of 10 years in prison.

Wire fraud, which carries a maximum sentence of 20 years in prison.

This is the scariest lawsuit of all, the one he is most likely to go to jail for.

How much jail time will he actually serve? This is anecdotal, but I have spoken to a bunch of people, and most are generally expecting 5-10 years. Metaculus has a market on this, lol — they are estimating 54 months in jail, or roughly 4.5 years:

Manifold Markets has a funny market: “Will Avraham Eisenberg be freed from incarcaration before the development of AGI?”

For context, Metaculus is currently predicing that AGI will arrive by 2030. So, the above Manifold market is pricing in a 57% chance that Avi will be free before 2030, meaning they are pricing in a 57% chance that his sentence is less than 7 years in duration.

These are all guesses… so take them with a grain of salt… 2 years, 3 years, 4 years, 5 years, 7 years, 10 years, at the extreme I’ve seen some people guessing 10-20 years. At the other extreme Protoss staff say, " Eisenberg is expecting to make a plea and do two years or less in prison overall." I am not sure where they got that “two years or less” estimate from, I am guessing they made it up.

Overall, it’s safe to say that people are expecting 2-15 years in prison for Avi… it seems like he is screwed, especially considering that federal prosecutors have a 99.6% conviction rate.

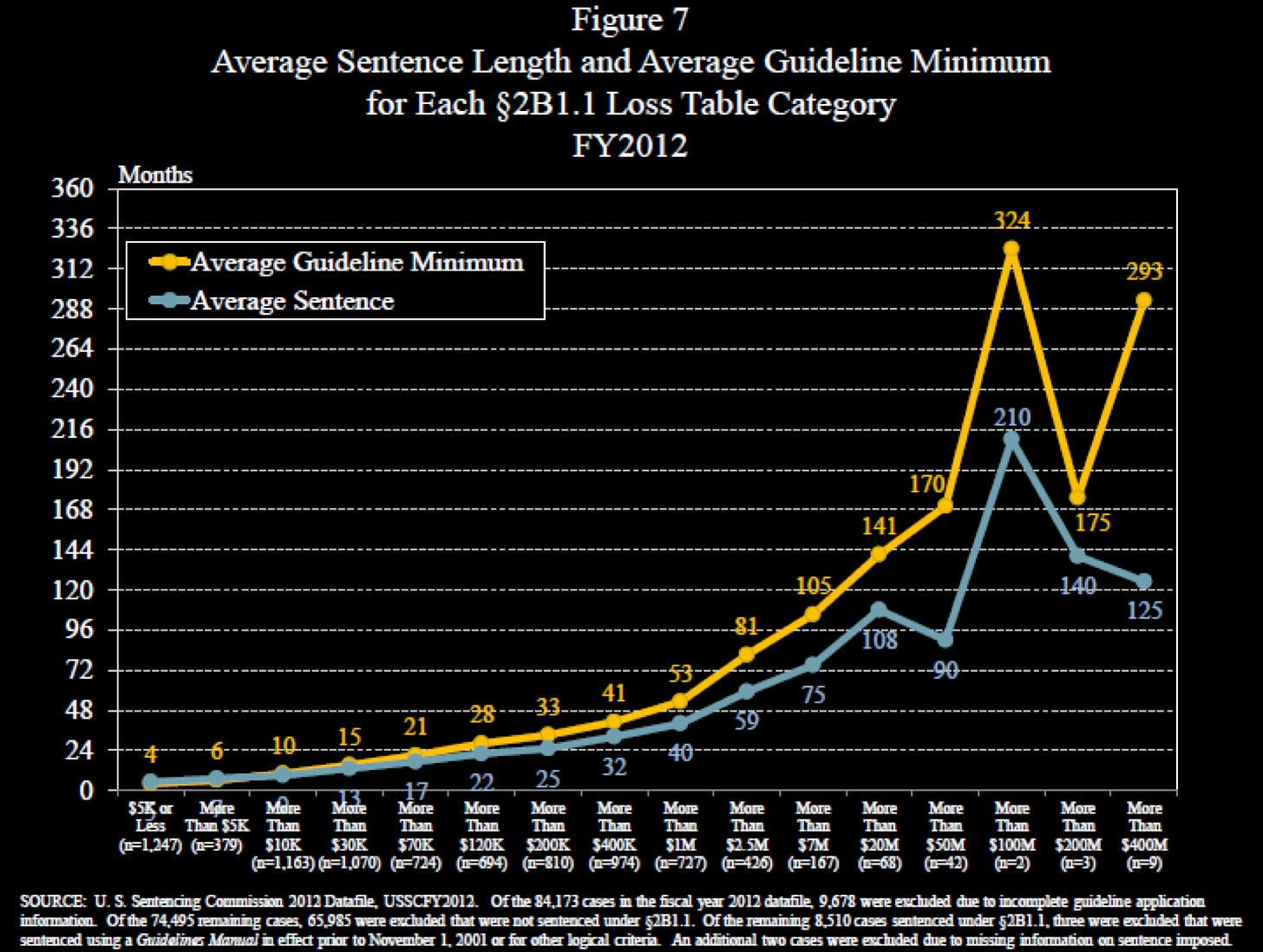

I am bearish on Avi’s sentence length — I think it will be on the higher end, because he stole sooooo much money, it’s hard to escape accountability. According to federal sentencing guidelines, the amount he stole exacerbates his crime by 24 “levels”:

What does increasing by 24 levels mean? I have no clue. The guidelines are confusing. For context, the entire sentencing guidelines is a scale of 43 levels of offense seriousness in which a “trespass” has a base offense level of “4”, while “kidnapping” has a base offense level of “32”, so Avi stealing $100 million rather than, say, $10,000, is equivalent to the difference between a trespass and a kidnapping.

If you really want to know how much time he will serve, look to history as a guide. This chart says that for people who steal $100 million, the average actual sentence handed down was 210 months — otherwise known as 17.5 years.

Noteable, the DOJ explicitly made no comment on whether Mango is a commodity or a security. However… the DOJ relied on the Commodity Exchange Act as the basis for prosecuting him, which is a pretty strong indicator that in the SEC vs. CFTC power struggle, the DOJ sides with the CFTC.

Conclusion

Hopefully you now understand why Avraham’s case are so important, and why I’ve written 5 articles about his exploits — this saga will determine if DAO votes are legally binding, and whether a crypto token is a “security” or a “commodity”.

Like Jesus Christ himself, Avraham Eisenberg sacrificed himself so that we may have regulatory clarity. Sadly, though, the clarity that we got here is that crypto assets may be regulated by both the CFTC and the SEC for the same activity and/or different aspects of the activity, and that crypto assets are both commodities and securities at the same time.

Great clarity, guys. Real coherent regulatory regime.

He did nothing wrong. Crypto should be a free-for-all

Sucks being that smart and letting the genius goto waste. Just another victim of this modern of technology. An isolated loser with zero friends, culturally encouraged to sue anyone and everyone possible.. making him think it’s ok to be a scumbag and get money anyway possibly regardless of any ethics, finds and exploits loopholes in crypto.. becoming mega wealthy.... but the sad loser can’t be happy still. Mad at the world because he has no friends, love and still a virgin. So he goes on Twitter and brags to a bunch of people that don’t give a shit about him and are all waiting and hoping for his crash and burn. Moral of the story? Being a ugly virgin genius is very veryyyy bad lol