Update: Woo Network Sheds 30 Million in Market Cap Following Karlstack Reporting

Don't walk away from this offshore bucket shop... run!

When I published my last article $WOO was trading at $0.225 per token.

As I write these words, 2 days later, the price is $0.207 per token.

There are 1,694,350,159.23 $WOO tokens in circulation.

Market Cap = Token Price * Circulating supply

Market Cap before my article = 0.225 * 1,694,350,159.23 = ~$381 million

Market Cap after my article = 0.207 * 1,694,350,159.23 = ~$350 million

Subscribe to Karlstack to get alpha in your inbox:

The main criticism of my article, which received a nasty backlash from hundreds of WOO cult members on Twitter, was that I was "fudding." I am told that I am intentionally spreading fear and uncertainty in order to profit from the potential decline of the WOO coin. This theory is incorrect. To provide full disclosure: I have no investment or involvement in WOO or any financial products associated with it. In fact, I only ever possessed only one crypto wallet, which was held at FTX. When FTX imploded I never bothered to get a second wallet.

I encourage those who staunchly defend WOO to engage in introspection and critically evaluate their own perspectives. Are you lying to yourself? Are you blinded by your bags?

Even fuller disclosure: I wish I was short $WOO before I published my article.

I wish I had profited off the 10% drop in the token.

Even if I did short this (I didn’t)…. So what?

Hindenberg Research, for example, is a hedge fund that specializes in identifying and exposing instances of corporate fraud and misconduct. I see no moral problems with what they do; if anything, they are safeguarding the interests of investors. Likewise, I am providing a public service by warning you early: WOO is a sketchy exchange with questionable practices, they almost certainly gamble with your money while lying to your face about not gambling with your money.

Yesterday, WOO X addressed the rumor that was causing their market cap to plumment.

Well, kind of.

In the same breath that the brag about transparency, they ignore the top reply to this tweet, and instead reply to other random softball questions in the mentions.

WOO's "brand ambassador" then took to Twitter to assert that depositors must simply trust the company's assurance that speculative activities are not being undertaken with customer deposits.

WOO subsequently issued a statement to Wu Blockchain, intending to refute my article.

Their rebuttal asserts the following:

Both Kronos Ventures and WOO Network are independent business entities. Both parties adhere to compliant corporate governance processes, and strictly control the use of funds through practical financial management and responsible resource allocation. Any other hints and statements lack actual evidence.

Here is my rebuttal to their rebuttal:

Both Alameda Research and FTX are independent business entities. Both parties adhere to compliant corporate governance processes, and strictly control the use of funds through practical financial management and responsible resource allocation. Any other hints and statements lack actual evidence.

In addition to the concerns expressed in my initial article, I would like to address some fundamental issues with WOO's business model. Their claim of being a "zero fee" platform raises sooooo many red flags. Here is an overview of their fee schedule:

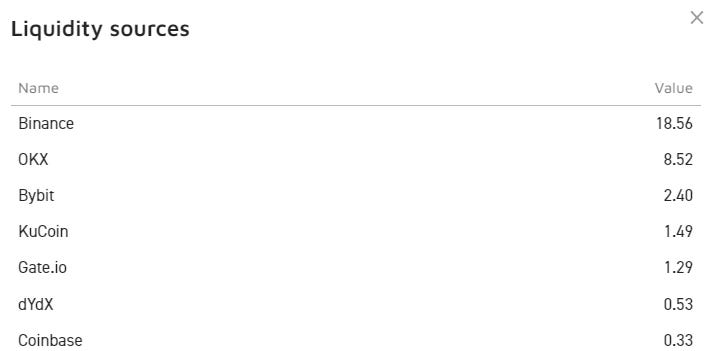

While it is apparent that they generate minimal revenue from fees, it is noteworthy that they hold $18 million on Binance alone, engaging in lords-knows-what trading with those funds and incurring fees every step of the way. Every time they participate in a market, they are required to pay fees to Binance.

Considering this disparity between fee collection and fee payment, it becomes evident that WOO would constantly be losing money based on this flow of fees alone. The only way to sustain their operations in the long run and counteract this continuous financial drain would be by recruiting new investors, which is the definition of a Ponzi scheme. Lol.

A new scandal broke today showing that Binance, the platform to which WOO lends the most money, has been caught doing exactly what I am accusing WOO of doing. Good timing, Binance.

In fact, today’s Binance scandal serves as proof that, by lending funds to Binance, WOO has ALREADY gambled with user funds and therefore violated their own terms of service.

WOO lent money to Binance, and then Binance gambled with the money.

Therefore WOO gambled.

Moreover, the fact that WOO has over 100 employees raises questions about how they sustain their workforce. It becomes evident that they are potentially gambling with user funds and using the proceeds from their speculative activities to cover their expenses. The profitability of their gambling endeavors remains uncertain, and if they are not successful, they may already be insolvent, who knows, you would never know until it was too late, as was the case with FTX.

In conclusion, I reiterate my call for current or former WOO/Kronos employees to contact me, anonymously, or on the record, providing any tips or information they may possess. The offer still stands at chrisbrunet@protonmail.com.

I have a proven track record of safeguarding individuals who disclose sensitive information and act as whistleblowers. As an illustration, I recently broke a story based on an anonymous source regarding leaked admissions data and Harvard's affirmative action practices. I can show you a dozen more examples where I have maintained the confidentiality of my sources while delivering impactful stories.

To support my ongoing investigative efforts, I encourage you to subscribe.

Shorting is also such a pain in crypto because sometimes you have conviction on something but your capital is on another chain that doesn't gave that token :-(