This article was made possible thanks largely to the research of , please subscribe to his Substack and follow him on Twitter if you crave crypto alpha.

FTX's collapse, which I am sure we are all familiar with, was largely due to them using their hedge fund, Alameda Research, to engage in risky gambling with user deposits. Alas, Alemeda Research turned out to be terrible gamblers, and they gambled away all of their user deposits, leading to FTX’s insolvency.

A similar situation may be unfolding with WOO X, a decentralized crypto trading platform based in Taiwan. For those unfamiliar, WOO X can be understood as a smaller and more decentralized version of FTX; please read TechnicalRoundup & WOO X — Deep Dive: A full introduction to WOO Network to get up to speed. WOO Network maintains a market cap of $371 million USD and has nearly 200k followers on Twitter.

Upon visiting WOO X's website, they proudly state that they are "trusted by the best." It is worth noting that FTX also enjoyed a similar level of trust before its downfall.

If I were you, I wouldn't feel comfortable keeping my money in WOO X. I would advise withdrawing my funds as soon as possible. Although the death spiral has not yet materialized, it is highly likely to occur if my analysis is correct.

I want to clarify that the purpose of this article is not to incite a bank run on WOO X, although such an unintended consequence could arise. If a bank run were to occur, it would not be my fault; rather, WOO X would be accountable for its poor risk management practices and lack of transparency. An exchange should possess the resilience to withstand scrutiny from bloggers who notice its vulnerability to a bank run. In my opinion, WOO X has been fortunate thus far to have avoided a fatal bank run. Once the public realizes the extent of its insolvency, the consequences will be dire.

If I am mistaken... if I am wrong… if WOO is completely solvent… with no hidden issues… and absolutely won't enter a death spiral… then they should have no difficulty surviving a bank run, correct? They should have no objections to me writing this article; in fact, they should embrace my scrutiny! If all the funds are accurately documented, they should have the ability to reimburse all depositors without any trouble.

You do have faith in "WOO X," don't you, anon...?

Surely, "WOO X" wouldn't deceive you, would they...?

Similar to FTX, which had a questionable hedge fund (Alameda Research) linked to it, engaging in risky activities with user deposits, Woo also has a dubious hedge fund attached to it. The name of WOO X's hedge fund is Kronos Research.

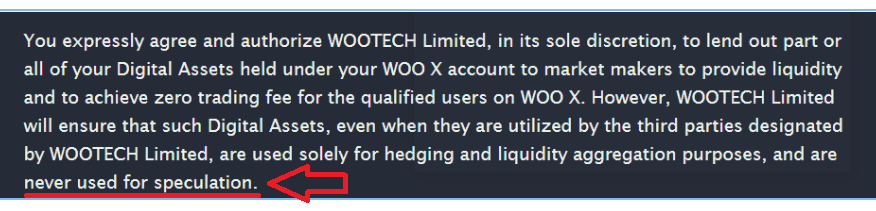

My thesis is straightforward: FTX had Alameda Research, and WOO X has Kronos Research. Although I lack concrete evidence, I suspect that Kronos may be employing WOO X's deposits for speculative purposes, which their terms of service forbids. These suspicions are significant enough that I would withdraw my funds from WOO X if I had any, and I would advise my friends and family to do the same.

WOO X openly acknowledges that they have full discretion to lend out user deposits for any purpose they deem appropriate. Therefore, if you deposit $1 million worth of Bitcoin into WOO X, it does not necessarily mean that $1 million worth of Bitcoin is held as backing for your deposit. Anything could be backing your deposit.

If you read WOO X’s terms of service, they explicitly state that they will not use your deposits for speculation.

Bullshit.

I am calling bullshit.

I am a highly skeptical person, and I simply cannot accept their claim that they are NOT speculating with user money at face value. We’ve seen this story play out a million times before in crypto world, it’s always the same story, and my suspicions are further confirmed when we analyze WOO X's balance sheet, which raises serious concerns.

Red Flag #1: Custody Ratio

Highlighted on WOO X’s front page is this:

Even in the most optimistic scenario of a bank run, WOO X can only cover approximately 80% of deposited funds. This is comparable to a bank admitting, "We have $56 in our checking account and $70 in liabilities”, and yet people continue using that bank. The degree of insolvency may be debatable, but the fact remains that WOO X is insolvent. They can’t survive a bank run. Don’t trust them with your money.

It’s just crazy to me; I almost feel like they've ascended as scam artists to a new territory where they can openly state they have less assets than debt, and the crypto world shrugs it off. These are the most transparent scammers I’ve ever seen.

I even saw a private messages from one of WOO X’s “brand ambassadors” who admitted, “the model is controversial, let’s be up front about it.”

Red Flag #2: Backed by a Shitcoin

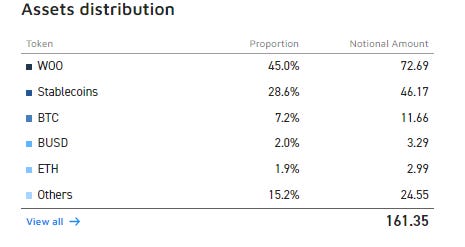

As per their own proof of reserves…

https://woo.org/proof-of-reserves

… a significant red flag arises from the fact that 45% of WOO X's asset composition consists of their own shitcoin, $WOO, which holds questionable (lol) value.

Take a moment to carefully consider the following: WOO X relies on the public's trust in their shitcoin to back 45% of its operations. If, for any reason, the public loses trust and succumbs to panic, leading to a significant decline in the value of this shitcoin, a perilous death spiral is likely to ensue.

The situation worsens when examining WOO X's reserves through a reliable third-party source, rather than relying solely on WOO X's internal estimates.

https://portfolio.nansen.ai/dashboard/woo-x

This estimate suggests that WOO X is even more heavily reliant on $WOO than they openly acknowledge (are they lying about their $WOO exposure!?). This raises suspicions that the entire operation may be an elaborate confidence scam, wherein once trust in WOO X is lost, the anticipated death spiral will come into effect.

Red Flag #3: Nebulous Slush Fund

It appears that Kronos Research enjoys unrestricted access to user deposits without any clear limitations or justifications. Operating as a proprietary trading firm, Kronos engages in undisclosed trades within a blacK box that lacks transparency and accountability. Moreover, the Proof-of-Reserves (PoR) system employed by WOO X raises concerns due to its allowance of Market Makers (MMs) to trade with client funds on other exchanges. They don't mention who the other exchanges are that MMs trade on with client funds, which is concerning because it could be like a domino effect, 1 of those fails, followed by more, which knocks over WOO X. WOO X claims they are “decentralized”, but are actually exposed to a ton of systemic, centralized risk.

While Kronos Research claims to employ a delta-neutral strategy, doubts persist regarding their credibility. You have to trust their word that are not using their secret, proprietary slush fund to gamble. Lol. Sure. Alameda Reserach made the same claim.

Further cause for alarm arises when observing Kronos' investments in various cryptocurrency firms, as evident on their website. Of course, this is exactly what FTX did — FTX took user deposits and invested in 500 random, shitty illiquid investments split across 10 holding companies — now Kronos is building the same illiquid porftolio (with user deposits??):

Kronos says they don’t speculate with user funds… and then Kronos immediately brags about their venture capital portfolio… are we REALLY supposed to believe that not $1 of user deposits was used to invest in these speculative firms?

Until this secretive trading firm open-sources every single trade they have ever made, we cannot be sure that they are not speculating with user deposits. The burden of proof is on them. The ball is now in their court.

Show me all your trades, and then maybe I will trust you.

The Faces That Would be Crushed by a Death Spiral

Occasionally, my work entails writing articles that may have significant repercussions, such as leading to individuals losing their jobs or facing legal consequences, similar to the case involving Avi Eisenberg.

These situations can weigh heavily on my conscience.

Allow me to present the dedicated staff of WOO X in Taiwan.

In the event of a potential bank run or a subsequent death spiral sparked by this article, they would be among those impacted.

I want to emphasize that I harbor no ill will towards these individuals, as they appear to be pleasant and capable. However, it is crucial to acknowledge the insolvency of the exchange they are associated with. By pointing out this reality, if the exchange ultimately suffers due to being poorly structured or resembling a fraudulent scheme, the responsibility lies with its creators. It is not my fault for identifying these issues; rather, it is their responsibility for establishing such a flawed enterprise. They must accept the consequences of their actions. You made your bed; now lay in it.

If, in the future, sometime next week maybe, news emerges about the collapse of WOO X resulting from an emergency bank run and subsequent $300 million dollar death spiral, remember: you heard it on Karlstack first.

That really does signal some brass ones, straight out telling people you are insolvent on your web site. It leaves me thinking either they are supremely confident that they will continue growing their asset base, or that they don't actually understand what insolvency is with regards to a bank.

Neither is terribly comforting for their investors and customers, I imagine.

Always kind to share, even though, at what point can people be expected to do more dur diligence